Based on those tests, we’ve picked the best trading platforms and apps in South Africa and listed them in the following guide.

In This Guide

Our Picks of the Best Forex Trading Platforms & Brokers in South Africa:

- Best Forex Trading Broker: Forex.com

- Best Forex Broker for Range of Offerings: AvaTrade

- Best Forex Broker for Trading Experience: IG Markets

- Highest Leverage CFD Forex Broker: CMC Markets

Which is the Best Forex Broker in South Africa?

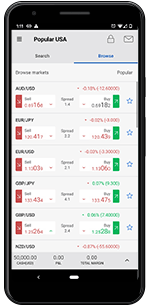

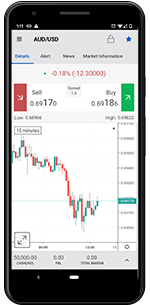

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com is an online broker offering a great forex trading service, with over 80 currency pairs, including ZAR, with both major and minor currencies. They also feature two platforms – MetaTrader 4 and their own Advanced Platform.

Besides trading forex, Forex.com falls a bit flat. Even though this broker offers a range of CFDs to trade with, the selection of other assets leaves a lot to wish for.

Compared to other brokers, Forex.com also charges higher fees for trading certain assets.

In other words, Forex.com is a great forex broker in South Africa, as long as you stick to trading forex. If you’re looking to combine forex trading with other forms of trading, there are several better-suited brokers on this list.

Which is the Best Forex Broker for Range of Offerings in South Africa?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

AvaTrade has made a name for themselves as one of the leading software developers around.

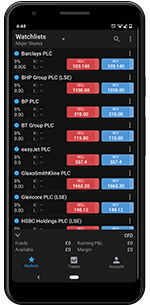

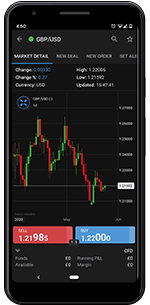

It has five trading platforms for desktop users. Besides, AvaTrade also offers forex trading apps called MetaTrader 4 and AvaTradeGo, which is one of the best and most advanced mobile trading apps on the market right now.

However, similar to Forex.com above, AvaTrade has a rather limited selection of assets, and even though their proprietary app is great to trade with, you will have to switch between that and the MT4 to get the best opportunities.

Naturally, switching between platforms is not optimal when trading, meaning AvaTrade is good for those who trade FX using their phones, but probably not for other traders.

Which is the Best Forex Broker for Trading Experience in South Africa?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

IG Markets is a legendary name in the online trading sector. This British-based broker has over 40 years of experience in the field, and their focus on stock trading makes them the top stockbroker in South Africa.

With over 12,000 assets, most of which are stocks, including South African stocks, you gain access to an unparalleled trading experience.

Since IG Markets offers a range of different platforms, many beginners find it hard to figure out which one that suits them the best.

The same problem also makes it harder to switch from investing in stocks to trading forex or other assets, since you have to switch platforms for almost every market.

Which is the Best Forex Trading Platform in South Africa?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

We are not the only ones that wholeheartedly believe that CMC Markets offers one of the best forex trading conditions in South Africa. Over the years, CMC has been awarded not one but several prestigious awards for their forex trading.

CMC Markets also offers CFDs and spread betting, making it one of the greatest all-around online brokers on

Despite a large number of stocks and other assets and good trading software, there are several things CMC Markets could do to optimize their service.

For example, CMC Markets still charge a commission for many stocks, and there is a lack of additional services and features, such as copy trading.

Guide for Traders in South Africa

Online trading, as well as more traditional long-term investing, is readily available in South Africa, with a large number of brokers to choose from.

Furthermore, South Africa has its own thriving economy and stock exchange – Johannesburg Stock Exchange (JSE) – which is the biggest in exchange in Africa and the 19th biggest in the world, based on market capitalisation (data from 2019).

Naturally, this situation creates great opportunities to trade and invest, both internationally and domestically.

However, the large number of great brokers and trading platforms in South Africa is a blessing in disguise. While it gives you a lot of options to choose from, it also makes it harder to pick a broker.

Luckily, we have great tips on how you can zero down on the best broker in South Africa for you.

1. Pick a Market

Before searching for a broker, you need to know what you’re going to trade or invest in. Using the recommendations above, you can find everything from the best trading platform in general, to the best forex trading app, and everything in between.

2. Compare Brokers

With a market in mind, you should be able to find a couple of brokers that could fit your needs. Now it’s time to compare them, which is best done in two steps.

Step one involves using our comprehensive South African broker reviews, as well as the guide above, to get a summarised idea of what differentiates the brokers.

Step two involves registering a demo account with the brokers, to try them out. Demo accounts are free to use and allow you to test the platforms without risking any money.

3. Bonus Tip

As soon as you can – preferably even before you start trading – you need to study the basics of trading and start developing strategies. This will greatly improve your ability to make a profit in the long run.

All the best brokers in South Africa offer educational tools, guides, and even webinars, but there is a ton of other useful material in books and online.

How to Choose the Best Trading Platform in South Africa

Picking the best trading platform in South Africa can be a daunting task.

That’s why our team has spent hundreds of hours researching all the top brokers in the world, as well as the top brokers in South Africa, specifically.

In turn, that means you can save an awful lot of time by referring to our detailed and unbiased reviews.

Our number one priority is our readers’ safety, and we only recommend brokers that are tightly regulated with licenses from the leading regulatory bodies in the world.

The Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) in the EU are two of the most accredited governing organisations.

Moreover, South Africa has its own financial regulatory body; the Financial Sector Conduct Authority (FSCA), who are responsible for overseeing and regulating all financial institutions in the country, including brokers and the Johannesburg Stock Exchange.

*Note – brokers that are regulated elsewhere, such as in Europe, are allowed to operate in South Africa without a license from the FSCA.

How Do I Start Trading in South Africa?

You start by signing up for the best trading platform for beginners in South Africa, ie. AvaTrade.

AvaTrade is a safe and fully regulated broker that is legally operating in the country.

Besides finding a good broker to start trading with, you have to learn how to actually trade or invest. This is a time-consuming task that will require many hours of studying, as well as trial and error while trading with real money.

The sooner you start educating forex yourself, the sooner you will have an honest chance of succeeding as a day trader in South Africa.

How Much Money Do You Need to Start Trading in South Africa?

Technically, all you need to start trading in South Africa is the minimum deposit amount needed to activate your trading account.

This amount differs from broker to broker and ranges from $50 to $250.

However, we recommend that you set a budget dependent on your disposable income, before you start trading.

The golden rule is to never invest or trade using funds you can’t afford to lose.

Is Trading Legal in South Africa?

Yes, all forms of online trading and long-term investments are legal in South Africa. The financial sector is overseen and regulated by the Financial Sector Conduct Authority (FSCA) – formerly the Financial Service Board (FSB).

In addition, all the best and most trustworthy brokers are regulated by organisations from all over the world, including Europe, Asia, Australia, and even the United States.

Do Traders Pay Tax in South Africa?

Yes, the South African Revenue Service (SARS) considers all trading and investment-related profits as income that has to be declared and taxed. You can learn more about your legal tax requirements on the SARS website.

There are certain tax-free savings accounts that you can open in South Africa where you can make long-term profits without having to pay taxes. PSG is a financial institution and broker that offers tax-free savings accounts and much more.

FAQ

How Much do Forex Traders Make in South Africa?

Only a small number of forex traders make a profit in the long run. That is the truth we all have to accept.

In fact, upwards of 90% of all traders globally, lose money when trading forex and other derivatives, such as CFDs.

By starting small, practising, and constantly educating yourself, you can greatly improve your chances of making money when trading forex.

What Time Does Forex Open in South Africa?

The foreign exchange market (forex) is a global and decentralised financial market that has varying opening hours in different parts of the world, resulting in the forex market being open 24 hours a day, five days a week, depending on the currency pairs you’re trading.

Local markets in South Africa are open between 09:00 and 17:00, five days a week. Find a great forex broker with the help of our recommendations.

What Are The Best Times to Trade Forex in South Africa?

Most trading in South Africa is conducted between 09:00 and 17:00, although you can technically trade forex 24 hours a day, five days a week.

Does FNB Bank Allow Forex Trading?

Who is the Best Trader in South Africa?

After becoming Africa’s youngest self-made millionaire at 23 years old, Sandile Shezi is widely considered to be one of the most successful forex traders in South Africa.

With that said, there is no official list of the best trades in the country.

How Can I Trade Online in South Africa?

How Do I Trade Forex in South Africa?

In our opinion, the best way is to register an account with Forex.com – the best forex broker in South Africa.

Do Forex Traders Pay Tax in South Africa?

Yes, all profits made from forex trading have to be declared and taxed in accordance with the South African Revenue Service’s (SARS) guidelines.

How Much Tax Do Forex Traders Pay in South Africa?

The amount of tax traders pay can vary from person to person. Therefore, we suggest referring to South African Revenue Services (SARS) to ensure that you pay the taxes you’re obligated to pay.

Can I Start Trading with 100 ZAR?

No, 100 ZAR equals roughly 5 USD, which is not enough to cover any broker’s minimum deposit amount.

However, many brokers allow you to deposit as little as 5 USD after you’ve activated your account, meaning you can use 100 ZAR to trade.

Conclusion

The combination of a booming economy and a tightly regulated financial market makes South Africa a hotspot for online trading and investment opportunities.

By using our tips and recommendations of the best brokers and trading platforms in South Africa, you can easily find a broker that suits you perfectly.

Don’t forget to always stay safe and only use regulated and licensed brokers, such as the ones you find above. We have spent hundreds of hours testing, reviewing, and comparing South Africa’s brokers and only recommend the safest options on the market.

Note: No information, nor financial advice related to online trading is offered through comment.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.Our Author:

COMMENTS