In This Guide

Our List of Best Stock Brokers & Platforms in Singapore

- One of the Best CFD Stock Trading App: Plus500

- Best Stock Options Trading Platform: TD Ameritrade

- Best Stock Brokerage Account: OCBC Securities

- Best Stock Stock Broker: IG Markets

- Best Stock Trading Platform For Beginners: CMC Markets

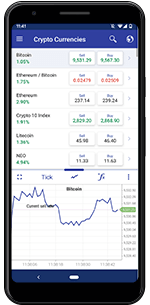

Which is one of the Best CFD Stock Trading App in Singapore?

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Plus500 offers everything you need as a trader in Singapore. It has a limited, but exciting selection of asset classes, a great platform.

Though Plus500 is a very user-friendly platform, CFDs are complex financial products, thus the platform is not suitable for beginners.

The broker is also known for its groundbreaking trading app and for the fact that it was the first broker to ever launch a CFD on Bitcoin, thus changing the cryptocurrency market forever.

Keep in mind that Plus500’s desktop platform is slightly more efficient than the app. Also, with a selection of merely 2,000 assets, many traders will feel limited in terms of opportunities.

Which is the Best Stock Options Trading Platform in Singapore?

✔ One of the biggest brokers in the world

✔ Global reach with fantastic investment opportunities

✔ Expensive to invest with

✔ A limited selection of securities in certain jurisdictions

✔ One of the biggest brokers in the world

✔ Global reach with fantastic investment opportunities

✗ Expensive to invest with

✗ A limited selection of securities in certain jurisdictions

Fees: Commission and fees

Demo account: Yes

Min deposit: N/A

Assets: Thousands of securities and derivatives

License: CFTC, the SEC, FCA, etc.

TD Ameritrade is an American-based broker that dominates the trading and investment sector around the world.

Thanks to TD Ameritrade’s prominent reputation in Singapore, and the large number of options offered, there is no doubt that TD is the best options trading platform in Singapore.

Before registering a TD Ameritrade account, you need to be aware that the broker charges rather high fees for a lot of trading and investments. Also, there are no domestic options available in Singapore. Instead, most investors use TD to trade and invest in U.S. options.

Which is the Best Stock Brokerage Account in Singapore?

OCBC Securities is a part of the massive OCBC bank organization and it is, by far, one of the best local brokers in Singapore. Investing in a range of domestic and international securities online with the help of OCBC's excellent trading support.

✔ Top bank and brokerage in Singapore

✔ Well-established and trustworthy

✗ Limited availability abroad

✗ High commission and fees

✔ Top bank and brokerage in Singapore

✔ Well-established and trustworthy

✗ Limited availability abroad

✗ High commission and fees

Fees: Commission and trading/non-trading fees

Demo account: No

Min deposit: N/A

Assets: Thousands of securities

License: Monetary Authority of Singapore (MAS)

Based on our comprehensive testing, we’ve confirmed that OCBC Securities has the best brokerage account in Singapore.

In fact, OCBC does not only have one great account, but seven different accounts, based on your level of expertise, the securities you’re planning to trade, and your budget. They even have a leveraged forex trading account for those looking to trade FX, instead of traditional securities.

All customers even get access to their own personal broker working for OCBC, whose task is to help you perform at your best.

Since OCBC is more of a traditional brokerage compared to a more basic online trading platform, you will be paying higher fees and commission to use this broker.

Another issue with this broker is the large number of different platforms and apps, meaning you may have to download and use more than one platform.

Which is the Best Stock Stock Broker in Singapore?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

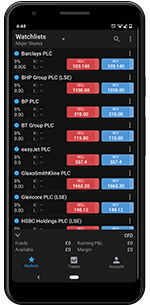

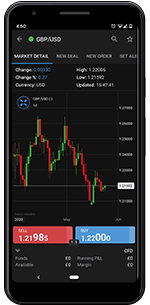

We would argue that IG Markets is the best stockbroker in Singapore, as well as one of the leading actors in the international stock trading sector.

With over 12,000 international stocks, including several domestic company stocks, you’ll never have a shortage of trading opportunities.

As we’ve pointed out before when reviewing IG Markets, this broker is best suited for advanced traders with previous experience. This is mostly due to the advanced platforms on offer, but also because of the number of assets, as it can be difficult to choose which ones to focus on.

In other words, there are better stockbrokers in Singapore if you’re a beginner, but as an experienced trader, few brokers can compete with IG Markets.

Which is the Best Stock Trading Platform for Beginners in Singapore?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC Markets has designed their platform called NextGen, which comes in a top-shelf mobile version for CFD and forex trading in Singapore, especially for beginners.

The app features a large number of assets (10,000+), fantastic live price data feed, and all the tools you need to excel on any market you prefer.

That being said, while non-trading fees are competitive, CMC Markets are known for slightly higher trading frees than some other brokers. The broker is also limited to CFD trading, meaning you don’t get direct market access to the Singapore Exchange (SGX).

Trading Guide for Singapore

Any trader, regardless of past trading experience, has to prioritize safety.

That is the number one tip we provide to all of you.

Now, besides regular risk management such as budgeting, hedging, and diversification, you should also only trade using safe and regulated brokers in Singapore.

When it comes to trading in Singapore, there is one body that oversees brokers and other financial institutes, namely the Monetary Authority of Singapore (MAS).

MAS is the central bank of Singapore and they are tasked with issuing licenses to brokers operating in the jurisdiction, including all online brokers in Singapore.

Our point is that you have to find a broker with a valid license to operate in the country.

With that said, there are several other top-notch regulatory bodies in the world, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investment Commission (ASIC) in Australia.

Continue reading our trading guide for more useful tips.

How to Choose the Best Platform, Broker and App in Singapore

As mentioned, safety is the number one concern when picking the best trading platform in Singapore, but there are other factors to take into consideration.

1. What Are You Trading?

Naturally, the biggest difference between brokers is often the assets they offer. As you can see in the recommendations above, some brokers specialize in stocks and commodities, while others are more focused on forex trading and CFDs, etc.

Therefore, your first step is deciding which asset classes you are interested in.

2. What’s Your Level of Experience?

The broker you choose will also depend a lot on how much experience you have. A broker like CMC Markets is beginner-friendly, with a simple, yet effective trading platform.

IG Markets and their advanced platform is, on the other hand, better suited for advanced traders.

3. How Big Is Your Trading Budget?

When trading, you always need to stick with a budget and only use money that you can afford to lose.

Subsequently, since brokers have different deposit methods and fees, you need a broker that matches your available funds.

How Do I Start Investing in Singapore?

By using our tips in the two sections above, you should be able to zero in on a couple of brokers that suit your needs.

Your next step is to test and evaluate the brokers on your own, preferably using a free demo account.

Then it’s time to start trading.

Remember that trading is a skill that requires a lot of practice and commitment, so you should start educating yourself as soon as possible.

Besides an endless amount of educational material online and in books, all the best brokers in Singapore offer their own trading materials and education.

Can I Trade Without a Broker in Singapore?

No, you cannot trade without a broker in Singapore since the broker is responsible for delivering you the trading opportunities.

However, you can invest in certain companies and securities without a broker.

Although, we do recommend using a broker because it gives you access to analytic tools, graphs, and other useful tools.

How Do I Trade Stocks in Singapore?

You can trade stocks in Singapore by using one of the recommended stockbrokers above.

The best stockbrokers in Singapore offer access to both international and local stocks from all over the world.

Is Trading Legal in Singapore?

Yes, trading is legal and fully regulated in Singapore.

The city-state has a friendlier position on the issue than regional neighbors.

FAQs

How Can I Trade Online in Singapore?

By opening an account with a regulated online broker, you can trade pretty much any asset or security that you like.

Use our reviews and tips to find the best online broker in Singapore for your specific needs.

How Can I Invest in Singapore with Little Money?

There are several ways you can do this. For example, by trading, rather than investing, you get “more bang for your buck”.

You also have the option of investing in options using TD Ameritrade. Options are derivatives based on underlying assets, which enables you to invest a fraction of the securities actual price.

How Can I Open a Trading Account in Singapore?

We suggest you use our Trading Guide in Singapore on this page to learn how you open a trading account.

The process of registering an account is not complicated, but you will have to verify your identity before you start trading.

Can Foreigners Buy Stock in Singapore?

Yes, there are several ways for foreigners to invest in stocks in Singapore. Check out these top stockbrokers to get started!

Conclusion

Singapore has a thriving financial market with lots of brokers, tight regulation, and low-to-no tax rates for traders.

In order to help you benefit from these favourable circumstances, we’ve tested and reviewed the top brokers in the country. Moreover, we’ve collected ratings and reviews from the leading services online.

The results of this work have been summarised in this article, for your convenience.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.Our Author:

COMMENTS