Forex trading in Nigeria can be one way to boost your income. With a good strategic plan and the best forex broker in your corner, you have a higher chance of being a successful and independent forex investor.

Many Nigerian investors, especially the newbies, find it challenging to identify a broker that suits their trading requirements. That is why we went out of our way to test and review the forex brokers in Nigeria. This is so that you can have the absolute best for your investment venture.

In This Guide

Our List of the Best Forex Brokers and Platforms in Nigeria:

- Best Forex Broker: HotForex

- Cheapest Forex Trading Platform: FP Markets

- Best Free Forex Trading Platform: Oanda

- Best Forex Broker for Professionals: Markets.com

- Best Forex Broker for Beginners: Forex.com

- Most Popular Forex Trading Platform: Pepperstone

- Best Forex Broker for Windows: HotForex

- Best Forex Broker for Mac OS: Pepperstone

Which is The Best Forex Broker in Nigeria?

✔ Numerous industry awards

✔ Negative balance protection

✔ Fast Account Opening

✔ Only Forex and CFDs

✔ Doesn't provide services to the USA and Canada residents.

✔ Numerous industry awards

✔ Negative balance protection

✔ Fast Account Opening

✗ Only Forex and CFDs

✗ Doesn't provide services to the USA and Canada residents.

Fees: Deposits and withdrawals are fee-free. Spreads and commissions are low, depending on account type.

Demo account: Yes.

Min deposit: $5

Assets: Great range of markets

License: FCA, DFSA, FSCA and FSA.

HotForex is a global forex and commodities broker that was founded in 2010. Having stayed in business for more than a decade, the broker boasts of registering over 2 million trading accounts on its platform. Your investment capital is safe with HotForex because it is regulated by world-class financial authorities, including the Cyprus Securities and Exchange Commission (CySEC).

HotForex offers various account types, including the Islamic account, to suit your trading requirements. You will require a minimum deposit of $5 to begin investing with this broker. Its forex trading commissions are low, which benefits frequent and low-budget investors. Additionally, Hotforex charges competitive spreads from as low as 0.1 pips. It also allows margin trading where you can leverage up to 1:1000.

The trading platform of HotForex is user-friendly and fully customisable. It is backed up with MetaTrader 4 and 5, making it suitable for all Nigerian investors. It also has various research and educational materials like recorded videos, forex trading webinars, and daily market analysis to keep you on top of your trading activities. The customer support service is also very responsive and available 24/5 through phone, email, and live chat.

Which is The Cheapest Forex Trading Platform in Nigeria?

✔ Fast account opening

✔ Tight Spreads

✔ Low Deposit Requirement

✔ High stock CFD fees

✔ Limited product portfolio

✔ Fast account opening

✔ Tight Spreads

✔ Low Deposit Requirement

✗ High stock CFD fees

✗ Limited product portfolio

Demo account: Yes.

Min deposit: 100$.

Assets: Great range of markets

License:ASIC CySEC NSEC

FP Markets is an Australian-based forex and CFD broker that was founded in 2005. Top-tier financial authorities regulate it, and its services in Nigeria are overseen by the Nigerian Securities and Exchange Commission (NSEC). You will find more than 13,000 tradable instruments across various global markets on this broker’s platform.

Opening a forex trading account with this forex broker is straightforward, and there is a minimum deposit requirement of $100. The cost of trading forex on FP Markets is relatively low. Its spread charges are among the tightest in the industry, starting from as low as 0.0 pips. Additionally, this forex broker does not charge non-trading charges and makes it excel as the cheapest forex trading platform in Nigeria.

If you like trading on MetaTrader 4 platforms, then FP Markets should be worth your consideration. It has a customisable user interface that includes colours of technical indicators. You will also have direct market access to global markets, where you will execute your trades directly on the order books of exchanges.

FP Markets has adequate research and educational tools. Its risk-free demo account is also available should you wish to test the forex broker and see if its offerings complement your trading requirements.

Which is the Best Free Forex Trading Platform in Nigeria?

Oanda is one of the world’s most elite online brokers based in New York and with a global reach that few brokers can compete against.

✔ Their unparalleled global reach

✔ 5 different platforms

✔ High fees and commission

✔ A limited selection of assets in some jurisdictions

✔ Their unparalleled global reach

✔ 5 different platforms

✗ High fees and commission

✗ A limited selection of assets in some jurisdictions

Fees: Commission, fees, and spread depending on the assets/securities

Demo Account: Yes

Min Deposit: 0

Assets: Thousands

Licenses: (CFTC), (FCA) & (IIROC)

Oanda was established in 1996 and has grown to be one of the most reliable forex brokers globally. It is regulated by the most stringent authorities, including the Commodity Futures Trading Commission (CFTC). Its trading platform is easy to use and fully customisable, making it one of the most preferred by Nigerian forex investors.

Opening a commercial forex trading account on Oanda is straightforward. There is a minimum deposit requirement of $20 for you to start investing. Its forex trading fees and spread are among the lowest in the industry, making it a preferred broker by low-budget forex investors in Nigeria.

Oanda’s trading platform is backed up with a wide range of trading tools, including technical analysis, MetaTrader 4 tools, and chasing returns, which will improve your trading experience. Additionally, the platform features educational tools for training, weekly online live webinars, and a risk-free demo account where you can test your strategies before opening a live trading account.

Although Oanda’s customer support service is available for 24 hours, five days a week, we assure you that they are one of the most responsive we’ve experienced. You can reach them via various communication channels, including phone, live chat, and email.

Which is the Best Forex Broker for Professionals in Nigeria?

✔ Perfect tools for learning and research

✔ Fixed spreads

✔ Commission-free accounts

✔ Not available for US clients

✔ Limited product portfolio

✔ Perfect tools for learning and research

✔ Fixed spreads

✔ Commission-free accounts

✗ Not available for US clients

✗ Limited product portfolio

Fees: High trading fees.

Demo account: Yes.

Min deposit: $250.

Assets: Large selection of assets including forex, commodities, shares and indices.

License: FMA, CySEC, FSCA and ASIC

Markets.com is a global forex and CFD broker offering more than 2,000 tradable instruments. This Cyprus-based forex broker is regulated by tier-one authorities, including the Cyprus Securities and Exchange Commission (CySEC). This makes it a safe broker for your investment requirements.

Markets.com account opening procedure is straightforward. Although its trading and non-trading fees and commissions are free of charge, brokers require a minimum deposit of $100 to start investing. Additionally, Markets.com charges spreads, which vary depending on the current markets’ volatility. There is also an inactivity fee of $10, which kicks in after three months of inactivity.

When it comes to this forex broker’s trading platform, you have options to choose from. There is an advanced Marketsx trading platform where you get the tightest spreads and a pool of technical tools to improve your trading experience. Another option is the Marketsi investment platform that is perfect for long-term expert investors. It is fully customisable and gives you full access to global markets without the need for a third party. Additionally, there are MetaTrader 4 and 5 derivatives platforms which are fast and backed up with hundreds of technical indicators.

The research tools covering fundamental and technical analysis are adequate for professional investors in Nigeria. Markets.com also has many educational materials, including webinars, videos, and demo accounts. On top of that, there is an in-built news feed to keep you up to date with the latest forex market trends.

Which is the Best Forex Broker for Beginners in Nigeria?

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com is a global trusted broker delivering a quality trading experience for forex and CFD investors in Nigeria, let alone globally. It boasts as the world’s biggest MetaTrader broker allowing access to more than 90 currency pairs and other financial securities, including cryptocurrencies and commodities.

Many investors find it easy to register a trading account on this broker’s platform because the process is straightforward. You will have to make a minimum deposit of $50 to start trading on Forex.com. There are no forex trading charges on Forex.com. The broker earns its profits from spreads which are among the most competitive in the market. Additionally, there is an inactivity fee of $15 every month should you fail to open positions for more than 12 months.

If you like margin trading, Forex.com allows access to leverage of up to 1:30. You will also be amazed by the broker’s research and educational tools. The research tools come in a wide range, including charting tools, trading tips from technical analysis, and top-notch market analysis, greatly benefiting all investors in Nigeria.

Ultimately, Forex.com is the best forex broker for beginners in Nigeria. This is because of its wide range of offerings and 0% commission for trades. You will not have to risk much of your investment capital. The broker also has a beginner-friendly demo account that we recommend you take advantage of and test how it works before creating a live trading account.

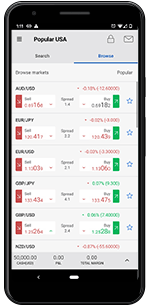

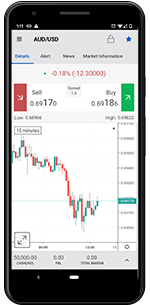

Which is the Most Popular Forex Trading Platform in Nigeria?

✔ Fast execution and low-cost trading

✔ One of the largest retail brokers

✔ Fast account opening with no minimum deposit

✔ US traders not allowed

✔ No guaranteed negative balance protection

✔ Fast execution and low-cost trading

✔ One of the largest retail brokers

✔ Fast account opening with no minimum deposit

✗ US traders not allowed

✗ No guaranteed negative balance protection

Fees: Low trading fees, non-trading fees, forex fees, no deposit fees.

Demo account: Yes.

Min deposit: $0

Assets: 150 financial instruments.

License: ASIC, DFSA, FCA, CySEC, CMA, SCB and BaFin.

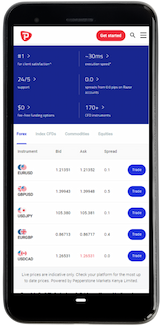

This Australian-based forex broker began its operations in 2010. We consider Pepperstone safe because it holds a world-class broker license from the Australian Securities and Investments Commission (ASIC). Other tier-one foreign authorities also regulate it, and its services in Nigeria are overseen by the Nigerian Securities and Exchange Commission (NSEC).

Pepperstone’s account opening procedure is fast and straightforward. It has a MetaTrader 4 platform that is backed up with 28 tools and indicators and is fully customisable to suit your trading experience. The broker allows margin trading of up to 1:500 on forex, so if you like the leverage application, you may want to consider Pepperstone.

The forex trading and non-trading charges of this broker are low. Its spread charges are also competitive, making it one of the most sought out forex brokers in Nigeria. On the flipside, Pepperstone has a minimum deposit requirement of $200 for you to start investing on its platform. It also charges high financing fees for positions held overnight.

If you are a Muslim investor in Nigeria, Pepperstone offers an Islamic account for you. It also has a very responsive customer support service which is available 24/5. Newbies can quickly improve their trading experience because this forex broker is loaded with educational materials like recorded videos, trading guides, and webinars.

Which is the Best Forex Broker for Windows in Nigeria?

✔ Numerous industry awards

✔ Negative balance protection

✔ Fast Account Opening

✔ Only Forex and CFDs

✔ Doesn't provide services to the USA and Canada residents.

✔ Numerous industry awards

✔ Negative balance protection

✔ Fast Account Opening

✗ Only Forex and CFDs

✗ Doesn't provide services to the USA and Canada residents.

Fees: Deposits and withdrawals are fee-free. Spreads and commissions are low, depending on account type.

Demo account: Yes.

Min deposit: $5

Assets: Great range of markets

License: FCA, DFSA, FSCA and FSA.

When it comes to the best forex broker for Windows in Nigeria, we take our hats off to HotForex. Its trading platform that features MetaTrader 4 and 5 is user-friendly and fully customisable. Although it is supported on all devices, its performance on Windows devices is fast and seamless, giving you an out-of-this-world experience.

HotForex is highly regulated by the most stringent financial authorities. It offers various account types, which include the Islamic account. Therefore, whether you are a novice or expert investor, Hotforex gives you the flexibility to invest at any level you see fit.

Which is the Best Forex Broker for Mac OS in Nigeria?

✔ Fast execution and low-cost trading

✔ One of the largest retail brokers

✔ Fast account opening with no minimum deposit

✔ US traders not allowed

✔ No guaranteed negative balance protection

✔ Fast execution and low-cost trading

✔ One of the largest retail brokers

✔ Fast account opening with no minimum deposit

✗ US traders not allowed

✗ No guaranteed negative balance protection

Fees: Low trading fees, non-trading fees, forex fees, no deposit fees.

Demo account: Yes.

Min deposit: $0

Assets: 150 financial instruments.

License: ASIC, DFSA, FCA, CySEC, CMA, SCB and BaFin.

Pepperstone is a forex broker that is supported on all devices. However, its performance on Mac OS devices is impeccable because it executes trades simply and straightforwardly, making you stay on top of your trading activities. Additionally, you can easily download its trading app on your iOS mobile device and keep track of your trading activities wherever you are.

The procedure for opening a forex trading account on Pepperstone is quick and straightforward. You will have access to more than 60 forex pairs which you can trade as CFDs on a low commission. It also has a copy or social feature that is very compatible with desktop devices. With this feature, you can easily interact with other investors and automate your own trading strategies. Pepperstone also allows you to copy trades from expert traders and improve your trading strategies.

Ultimately, Pepperstone is a safe forex broker for your investment capital. Feel free to test it first by using a demo account before making a commitment.

Guide For Traders in Nigeria

If you know how forex trading works, you should also know that forex can be done anywhere as long as you have access to a desktop and a stable internet connection. Whereas forex trading is one way to build your nest egg, there are a few things that you need to be aware of to avoid falling into the hands of rogue brokers.

Licenses/Regulations

The Nigerian trading laws only allow you to invest in licensed and regulated brokers. Note that there are many local and international brokers extending their services to Nigerian investors. Therefore, if you want to trade with an international broker, make sure that you find one that is regulated by the Nigerian local authority (Nigerian Securities and Exchange Commission). Examples of such brokers are recommended in our mini-reviews above.

Trading currency

A forex broker in Nigeria should allow investors to use their local currency, Naira. You do not need to go through the hustle of currency exchange which can be costly and time-consuming. The forex brokers should allow you to make deposits and withdrawals using your local currency. You should also be able to trade with foreign currencies, including the US dollar.

Islamic accounts

It’s a no-brainer that about half of the Nigerian population are Muslims. Therefore, if you are a Muslim investor, your best forex broker should offer Islamic trading accounts that are free from swap charges. Trading with this account keeps you in line with your faith according to Sharia law.

How To Choose The Best Forex Brokers in Nigeria

The one question that most forex investors in Nigeria ask is, “How do I succeed trading forex?” Well, the answer is simple. Besides being knowledgeable and strategic, you need to choose the best forex broker that complements your trading requirement. Wondering what factors to consider? Read along.

Security

The security of your investment capital should be a priority. You do not want to risk your hard-earned funds with a broker and later realise that they are not legally approved to offer their service to Nigerian clients. Make sure that the forex broker you choose is licensed and regulated by world-class financial authorities.

Budget

If you have read our mini-reviews, then you should know that forex brokers in Nigeria have trading costs ranging from high to low. This is because of the market volatility and tradable instruments they provide. Therefore, we advise you to choose a broker you can afford if you want to enjoy your trading experience.

Trading platform

The best forex broker in Nigeria must have an easy-to-use, customisable trading platform. It must also offer the most attractive user interface. As a beginner, you need to choose a broker that will help you quickly improve your trading skills, so make sure that they have adequate educational and research tools. Additionally, confirm if the trading accounts have features that complement your requirements.

Customer service

Choosing a broker with reliable and responsive customer support goes a long way in increasing your chances of earning profits. The faster they respond to your issues, the quicker you familiarise yourself with how forex trading works, thereby improving your skills. Also, you may note that not all brokers are available 24/7. Therefore depending on your trading frequency, choose a forex broker with a customer support service that you are comfortable with.

Payment methods

The best forex broker in Nigeria should allow Nigerian clients to make deposits and withdrawals using the local Nigerian currency, Naira. There should also be a local payment method like Konga Pay, which is less costly, is fast, and saves you from the currency exchange hustles. There should also be other payment modes, including debit/credit cards, bank transfers, and e-wallets like PayPal and Neteller.

FAQs

Is forex trading legal in Nigeria?

Absolutely! Forex trading is legal for as long as you invest with a forex broker that is licensed and regulated by top-tier authorities. Their activities should also be overseen by the Nigerian Securities and Exchange Commission (NSEC).

Do Forex traders pay tax in Nigeria?

Yes. Every profit you make trading forex is subjected to taxation. This is because forex trading is considered a business venture in Nigeria.

How do I register for forex trading in Nigeria?

After confirming that you are above 18 years old, you need to find a suitable forex broker that compliments your trading strategies and create a forex trading account. Once you fund your account, you will have access to various tradable markets where you will have options to trade with.

What time does the forex market open in Nigeria?

Although the Nigerian currency time is usually available 25/5, the forex market opens on Sunday at 11:00 PM Nigerian time and closes on Friday at 10:00 PM Nigerian time.

Is Bitcoin legal in Nigeria?

Yes and no. This means that although you can trade using Bitcoin in Nigeria, using it as a legal tender is still prohibited.

How do I start trading forex in Nigeria?

First, you need to confirm your trading capital. Then, choose a suitable forex broker that is regulated by top-tier financial authorities. You can find these brokers in our mini-reviews above. Create and fund your trading account where you will access various instruments for trading.

Where can I learn forex trading in Nigeria?

The only place you can quickly learn forex trading in Nigeria is through online stock brokers. They are equipped with a wide range of educational tools like guides, videos, and webinars. Some of them even allow social networking, where you get to interact with more skilled investors.

Conclusion

Whether you are a novice or experienced investor looking for a forex broker and platform in Nigeria, we assure you that our recommended brokers above are worth considering. Should you decide to choose other forex brokers, make sure you follow our guide on the factors to consider. Remember that there are many fraudulent forex brokers in the Nigerian market. Therefore, the first step is to confirm a broker’s credibility before looking into other factors that we’ve stated above.

Note: Do not hesitate to contact us by leaving a message below. It could be any questions or comments regarding forex brokers in Nigeria or your tour on our website. We promise to get back to you promptly.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact usdirectly to learn more about the team.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact usdirectly to learn more about the team.

COMMENTS