Here Are the Best Trading Platforms, Brokers & Apps in Germany:

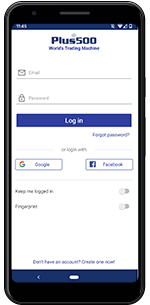

- One of the Best CFD Trading App: Plus500

- One of the Best Trading Platform: IG Markets

- One of the Best Stock Broker: CMC Markets

- One of the Best Investment Broker: DeGiro

- One of the Best Forex Broker: Forex.com

In This Guide

Which is one of the Best CFD Trading App in Germany?

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Plus500 is the great high-rated mobile trading software in the App Store and Google Play Store, based on close to 100,000 customer reviews.

In other words, this is not only one of the best trading app in Germany according to us, but also according to Plus500’s impressive number of customers.

With this trading app, you can trade CFDs on several assets, ranging from stocks and forex, to cryptocurrencies and commodities.

We would like to see more assets added to the platform since the selection is limited at the moment. It also wouldn’t hurt to have a few more advanced trading tools to better cater to professional traders.

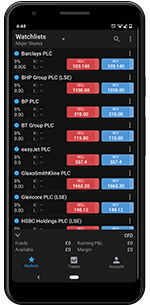

Which is the Best Trading Platform in Germany?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

Besides unrivalled experience in the industry, two things separate IG Markets from most of the competition.

Firstly, according to data from June 2020, IG Markets is the biggest CFD provider based on revenue. Secondly, with more than 17,000 assets on offer, they have a broader selection than anyone else.

Combine that with fantastic trading software, and it should come as no surprise why this is the best trading platform in Germany.

With that said, IG Markets tend to be best suited for more experienced traders. This broker also has a rather high minimum deposit, which not everyone can afford.

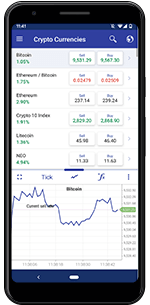

Which is the Best Stock Broker in Germany?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

With close to 9,000 international shares on offer and award-winning trading platforms, it’s not hard to see why CMC Markets is the best online stock broker in Germany.

Add to that a selection of Exchange-Traded Funds, as well as stock indices, including Germany DAX 30, and you’re guaranteed to always have exciting securities to speculate on.

Stock trading with CMC Markets is conducted on the Next Generation CFD platform, featuring all the tools you need to perform at the very top of your ability.

Unfortunately, you can’t buy stocks directly from the exchanges and you should expect to pay a higher spread on certain trades than you do with other brokers.

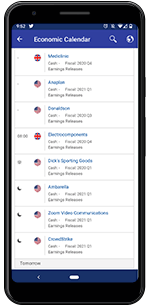

Which is the Best Investment Broker in Germany?

This Dutch-based financial institution has managed to develop a serious stock investment broker that feels and operates like a regular online broker.

To us, it’s a perfect combination.

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✔ No demo account

✔ Rather high commission

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✗ No demo account

✗ Rather high commission

Fees: Charges commission and other trading fees

Demo Account: No

Min. Deposit: N/A

Assets: Thousands

License: FCA and AFM (Netherlands)

DeGiro is a Dutch investment broker that was founded in 2008 and has quickly grown to become an innovative force in the European investment sector.

Today, they have more than 600,000 active customers and have been awarded 65+ prestigious awards.

This broker gives you access to over 60 international exchanges, including, but not limited to:

In other words, the best investment broker in Germany allows you to invest in securities from all over the globe.

With that being said, DeGiro, just like most investment brokers, charges higher fees and commission than CFD and forex brokers. They also don’t offer a demo account, which means you can’t test the broker before you register an account.

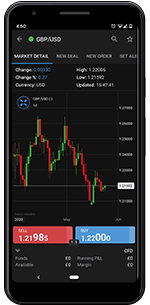

Which is the Best Forex Broker in Germany?

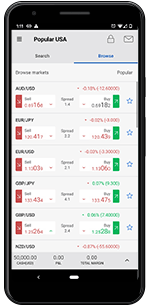

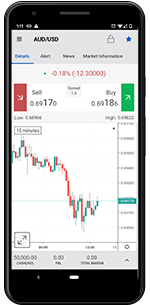

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com is one of GAIN Capital’s flagship broker services and it’s also the best forex broker in Germany right now. Furthermore, they are the biggest MetaTrader broker based on active customers.

This broker has more currency pairs on offer (90+ in July 2020) than most other brokers.

Besides Metatrader 4, Forex.com gives you access to a set of advanced trading platforms and tools on both desktop and mobile devices. These tools are perfectly suited for experienced traders.

Now, this broker could, and really should, improve the processing times for transactions. And, other than the 90+ currency pairs, you only have roughly 250 other assets to trade with.

That means Forex.com isn’t suitable for those looking to trade on other markets than the foreign exchange market.

Our German Trading Guide

Luckily, trading in Germany is both safe and accessible to everyone.

The task of regulating the German financial sector falls on Bundesanstalt für Finanzdienstleistungsaufsicht, better known as BaFin, or the Federal Financial Supervisory Authority in English.

It’s their job to supervise more than 4,000 banks, brokers, and insurance companies.

In other words, BaFin ensures that all brokers operating in Germany are following European laws regarding customer service, money laundering, etc.

In addition, the Cyprus Securities and Exchange Commission (CySEC) is tasked with issuing broker licenses and regulating online brokers in accordance with ESMA’s MiFID directive.

Our point is that it’s safe to trade in Germany, as long as you stick with a regulated and licensed operator, such as those recommended above.

How to Choose the Best Broker in Germany

Whether you’re looking for your first broker or you’re looking to change brokers, there are several factors to consider.

To help you, we’ve summarized the selection process into three manageable steps:

1. Safety and Regulation

Again, the most important thing to consider when choosing a new broker is safety.

All the best brokers in Germany are licensed by a respected regulatory body, such as CySEC, and overseen by BaFin.

Using an unregulated broker is never recommended and it might end with your funds being stolen or your personal information sold.

2. Assets and Platform

Naturally, your broker has to offer the markets you’re interested in.

However, it’s usually a smart idea to find a broker with a broad selection of assets since it gives you more options.

You also want an intuitive platform with tools and features that helps you perform at your best.

If you’re already used to a third-party platform, such as MT4, you can find another MT4 broker and enjoy that broker’s exclusive features.

3. Tests and Reviews

Lastly, you should open a demo account with the said broker and test the platform for yourself to ensure that you feel comfortable using it.

DeGiro is the only broker that we’ve recommended that does not offer a demo account currently.

As you can see above, we have collected broker ratings from Trustpilot, Play Store, etc. and those are great indicators of what brokers’ customers think of them.

How Do I Start Trading in Germany?

The first thing you need is a broker and by applying the tips and reading the recommendations shared above, you can quickly find one that suits you.

All the best brokers in Germany have educational material to help you get started. Some of them even offer regular webinars and personal trading tips.

Although, you should also consider in-depth studies using books, online courses, blogs, and videos.

Keep in mind that trading comes with certain risks. Therefore, you should always start small and never invest money you cannot afford to lose.

Is Day Trading Legal in Germany?

Yes, day trading is legal in Germany and all the brokers are supervised by BaFin, CySEC, as well as the European Central Bank (ECB).

As long as your 18 years or older and you’re using a legitimate broker and trade with your own funds, trading is fully legal.

Do Traders Pay Tax in Germany?

Yes, you pay taxes on your capital gains and profits made from day trading.

You are allowed to deduct up to €801 per year, per person, on your capital gains, which is great for recreational traders.

Since taxes are a serious matter, we always urge our readers to contact Bundeszentralamt für Steuern (BZSt) and educate yourself on your obligations. This is especially important considering the different community tax rates in the country.

How to Buy Shares in Germany

One of the easiest ways to buy shares in Germany is to register an account with one of the best stock brokers in Germany, such as DeGiro.

That will give you access to thousands of German and international stocks and securities, as well as the tools you need to make successful investments.

FAQs

Is Forex Trading Legal in Germany?

Yes, forex trading is legal in Germany. All the best forex brokers are regulated and overseen by BaFin and several other regulatory bodies.

Where Can I Trade Forex in Germany?

There are several forex brokers on the German market. Based on thousands of user reviews and our own extensive tests, we’ve found that Forex.com is the best forex broker in Germany.

What Time Does the Forex Market Open in Germany?

The foreign exchange market (forex or FX for short) is a decentralised market that is technically open 24 hours a day, 5 days a week.

Locally, the forex market in Germany is open during regular business hours, but by using an online forex broker, you can access currency pairs around the clock, between Monday and Friday.

Can I Invest in Germany With Little Money?

Yes, several of the best online brokers in Germany have low to no minimum deposit fees, meaning you can invest with little money.

CFD and forex brokers also provide margin and leverage that you help increase your exposure for each position. Just keep in mind that a vast majority of CFD traders lose money in the long-run.

Can Foreigners Buy Stocks in Germany?

Yes, there are plenty of brokers offering access to the German stock market where you can buy stocks, indices, ETFs, and other securities.

How Do You Trade Stocks in Germany?

By registering an account with a stockbroker in Germany and learning the basics on stock trading.

We have collected thousands of user reviews and done hundreds of hours of research to create a list of the best stock brokers in Germany above.

Conclusion

There is no shortage of great trading platforms in Germany and since the top brokers are regulated, you can trade and invest without worrying about your own safety.

Whether you’re looking for a forex, stock or investment broker in Germany, you now have the tools to find the perfect fit for you.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.Our Author: