In this guide, we simplify the long search processes by recommending the best stock brokers in several categories. We also guide you on what to look for when choosing a stock broker.

In This Guide

Our TOP 6 Best Stock Brokers and Platforms in Germany

- Best Stock Broker: CMC Markets

- Best Share and Stock Trading Platform: Interactive Brokers

- Cheapest Online Trading Platform: DeGiro

- Most Popular Stock Trading Platform: IG Markets

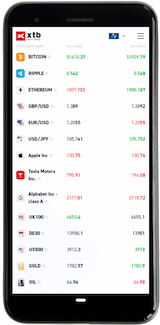

- Best CFD Stock Broker: XTB

- Best Free Stock Broker : DeGiro

Which is the Best Stock Broker in Germany?

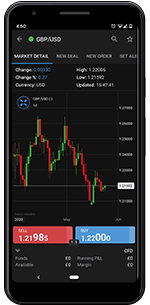

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC Markets is a well-established broker with German roots. It offers its trading services to all types of clients, from the novice, who wants to try their luck with trading, to veterans seeking exposure to an extensive range of assets.

Founded in 1989, the broker is licensed and regulated by one of the most highly regarded UK authorities, the Financial Conduct Authority (FCA). Its activities in Germany is also overseen by the Federal Financial Supervisory Authority (BaFin).

With this credibility, it continues to adapt to the ever-changing online brokerage trading system successfully. The broker accepts trades in Euro currency. Traders can also make deposits and withdrawals using local payment methods such as bank transfers, PayDirekt, and e-wallet .

Although CMC Markets has high stock CFD fees, it is still regarded as the best stock broker in Germany. It does not charge deposit and withdrawal fees, except for same-day and foreign withdrawals. It also does not require a minimum deposit amount. The mobile and web trading platforms are highly customizable with features that will make your trading experience worthwhile.

Additionally, the broker has incredible customer service with 24-hour telephone, live, and chat service. Its platform also has educational tools that will assist you in improving your trading skills. Try CMC Markets and let your first attempt be one among others to follow.

Which is the Best Share and Stock Trading Platform in Germany?

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✔ Long processing time for withdrawls

✔ High commission for small positions

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✗ Long processing time for withdrawls

✗ High commission for small positions

Fees: Rather high fees

Demo account: Yes

Min deposit: $100

Assets: Huge selection

License: SEC, IIROC, FCA, ASIC

Interactive Brokers (IBKR) is a US-based broker serving clients across the world, including Germany. Because it is one of the pioneer trading brokers, it is licensed and regulated by the top-tier authorities including, the Financial Conduct Authority (FCA) and the Securities and Exchange Commission (SEC).

IBRK has an extensive range of assets with low trading fees. The broker does not require a minimum deposit amount when you sign up. Its charges on ETF and stock trading are also low, making it a suitable choice for frequent investors.

The broker also has a variety of research and educational tools to help traders improve their trading experience. We recommend you try this broker using its free trial account and see if it will suit your trading needs.

Which is the Cheapest Online Trading Platform in Germany?

This Dutch-based financial institution has managed to develop a serious stock investment broker that feels and operates like a regular online broker.

To us, it’s a perfect combination.

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✔ No demo account

✔ Rather high commission

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✗ No demo account

✗ Rather high commission

Fees: Charges commission and other trading fees

Demo Account: No

Min. Deposit: N/A

Assets: Thousands

License: FCA and AFM (Netherlands)

DeGiro is a Dutch trading broker that was founded in 2008. It is regulated by top-tier authorities including, the Netherlands Authority for the Financial Markets (AFM), the Dutch Central bank (DCB), and the Financial Conduct Authority (FCA).

One thing that makes this broker stand out is its low fees on all instruments. This is one reason why it is rated the cheapest online trading platform in Germany. Its excellent mobile user interface, and web design allow traders to analyze markets and monitor their open positions easily.

DeGiro allows German traders to invest and make deposits and withdrawals in Euro. Unfortunately, the broker does not have enough education and resource tools to advance you as a trader. Therefore, this broker is best suited for expert traders.

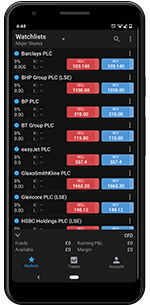

Which is the Most Popular Stock Trading Platform in Germany?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

IG Markets is one of the biggest brokers worldwide regulated by top-tier authorities such as the Financial Conduct Authority (FCA) and Germany’s Federal Financial Supervisory Authority (BaFin). The broker was founded in the 1970s. You can tell that it has been in the industry for a long time, making it a safe broker for German clients.

Although IG Markets’ charges are high on forex, CFD trading, and options, the broker does not charge deposit and withdrawal fees. The broker’s trading platform is also easy-to-use and customizable. The mobile application is also user-friendly, and you can monitor your trading activities anywhere, anytime.

Nothing makes a trading experience enjoyable, like accessing the right resource tools and educational materials. IG Markets ensure that you receive these tools by creating a platform to sign up for webinars, enroll in courses, and watch educational videos.

Feel free to invest with IG Markets. However, we advise you to first try the demo account, figure out if the platform, and the available resources, suit your trading requirements.

Which is the Best CFD Stock Broker in Germany?

✔ Easy to use, fully customisable

✔ Superior execution speeds

✔ Trader's calculator, performance statistics, sentiment

✔ High fees for stock CFDs

✔ Product portfolio limited mostly to CFDs and FX

✔ Limited fundamental data

✔ Easy to use, fully customisable

✔ Superior execution speeds

✔ Trader's calculator, performance statistics, sentiment

✗ High fees for stock CFDs

✗ Product portfolio limited mostly to CFDs and FX

✗ Limited fundamental data

Fees: Spread cost; Commissions; overnight financing costs; inactivity fees.

Demo account: yes.

Min deposit: $0.

Assets: huge selection.

License: IFSC, FCA, KNF, CySEC, DFSA.

XTB is a forex and CFD stock broker with its headquarters in Warsaw, Poland. It is regulated by highly regarded authorities, including the Financial Conduct Authority (FCA). This broker’s platform has excellent features and resources that will ease your trading activities while learning more strategies along the way.

The broker charges on stock CFD trading are relatively high. However, its non-trading fees such as deposits and withdrawals are free unless you make a withdrawal of more than 50GBP. The account opening procedure is also straightforward, making it suitable for beginners.

Note that XTB accepts Euro trading. You can also make deposits and withdrawals using a local payment method such as e-wallet and Giropay. This broker’s customer support is also reliable and available to German traders in various languages, including German.

RW: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76-83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Which is the Best Free Stock Broker in Germany?

This Dutch-based financial institution has managed to develop a serious stock investment broker that feels and operates like a regular online broker.

To us, it’s a perfect combination.

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✔ No demo account

✔ Rather high commission

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✗ No demo account

✗ Rather high commission

Fees: Charges commission and other trading fees

Demo Account: No

Min. Deposit: N/A

Assets: Thousands

License: FCA and AFM (Netherlands)

Since its inception in 2008, DeGiro has grown to be a force to reckon with in the European investment markets. Being one of the safest brokers in Germany, it offers a wide range of assets to choose from. Its account opening procedure is also fast and digital.

Additionally, there is no minimum deposit required with this broker, making it a perfect choice for traders with a low budget. It also does not charge deposit and withdrawal fees.

DeGiro lets you access more than 60 foreign exchanges, including Euronext. With this flexibility, it rates as the best free stock broker in Germany. Try DeGiro today by signing up for a demo account and explore the platform before committing yourself.

Guide For Traders in Germany

If you are reading this, then it probably means that you are looking for the best stock broker in Germany. You also might wish to know how to identify a suitable one for your trading needs. We understand that there is varying information out there that can complicate the broker identification process. That is why we take it upon ourselves to test and review online brokers so that you can make informed decisions.

Online trading can be interesting if you have a strategic plan that will help you earn profits consistently. You also need the requisite knowledge of how stock trading in Germany works. Additionally, and most importantly, you have to choose a good broker offering various assets that suit your requirements in one platform.

To succeed in your investment endeavors, you need to consider the following factors:

Trading laws and regulations

Every country has different laws and regulations, and Germany is no exception. The Trading laws of Germany states that it is legal to trade locally and internationally. It is also permitted that you invest with only licensed and regulated brokers. Most of our recommended brokers are regulated by top-tier authorities, including the Financial Conduct Authority (FCA) and Germany’s Federal Financial Supervisory Authority (BaFin).

We put a lot of emphasis on looking out for brokers who have the best licenses because of your security. You do not want to invest your money in a broker, only to realize that they are not legally approved.

Local markets

Every broker is required to follow through with the regulations of Germany. Therefore, brokers can only allow traders to invest in the areas that they are legally supposed to. You will find that whereas some brokers allow local trades, others will offer international. Some even allow both.

For example, if you are a US trader residing in Germany, you can only trade with foreign brokers who report to the US Internal Revenue Service (IRS). Local traders can find local brokers regulated by Germany’s Federal Financial Supervisory Authority (BaFin).

Trading currency

A broker who accepts different currencies, including Euro, should be what you need to consider. It shows that the broker has put your interest into consideration. Allowing you to make deposits and withdrawals using your currency saves you from the hustle of currency exchange, which consumes time and money.

The broker should also allow trading in other currencies. Meaning that if you make a deposit in Euro, you can trade in other currencies such as the US dollar.

Islamic trading accounts

More than 80% of the German population practice Christianity. However, there are also a few Muslims living and trading in Germany. For this reason, a broker needs to offer an Islamic account for German Muslims. You do not need to worry about violating Sharia law. Our recommended brokers offer Islamic trading accounts. So, if you are a Muslim residing in Germany, worry not because these brokers got you covered.

How To Choose The Best Stock Broker

Finding the best stock broker in Germany is not easy, especially if you are a novice in this industry. There are long processes that you need to follow to find your best stock broker. You need to go through user reviews, test the brokers, and compare them, which can be overwhelming and time-consuming.

Our recommended brokers have been tested and reviewed by our team of experts. With us, you will find the best brokerage firm that will engage you for a very long time.

Below are some of the factors to consider when choosing the best stock broker.

Security

The security of your investment should be of utmost importance. Before committing to a stock broker, make sure that they have the required trading licenses. Some of the brokers we recommend are regulated by the best authorities in the business, such as the Financial Conduct Authority (FCA) and Germany’s Federal Financial Supervisory Authority (BaFin).

Trading platform

A good trading platform must have an attractive user interface. It also should have the necessary resource tools and educational materials that will improve your trading experience. Many traders also prefer a stock broker with a reliable mobile application that they can use to monitor trades as they please.

Trading fees

Before committing to a stock broker, we recommend that you have a budget. This will assist you in selecting a stock broker that will make your trading experience worthwhile. Some brokers charge high trading fees compared to others. Some will even require a minimum deposit amount. Therefore, choose a broker whose trading charges are in line with your budget.

Customer support

Whether you are a novice trader or a professional who wishes to change a broker, you must consider the customer support of your potential stock broker. Customer support is what you need as a new member to guide you as you get to familiarize yourself with the platform. The broker’s customer service should also be reputable and available in your language, German.

FAQs

How do you trade stocks in Germany?

First, you need to know the basics of stock trading. Then, find the best stock broker that has offerings in line with your budget. Once you are ready, open an account where you will have access to various assets and start investing.

Where can I buy stock in Germany?

You can easily buy stocks in Germany through a legitimate online stock broker. Simply register your account with the broker and have access to various stock assets within your country.

How can I buy US stocks in Germany?

You need to find a stock broker offering US equities. Through this broker, you will be able to register as a non-resident investor, thereby having access to the US equities.

How much money do you have to start with on E*TRADE?

E*TRADE does not charge stocks and ETFs trading. Its non-trading fees are also low. To answer the question, you can start investing on E*TRADE with as little as $10.

Is forex trading legal in Germany?

Yes. Forex trading is legal in Germany as long as you trade with licensed and regulated brokers that are overseen by BaFin. Also, Malaysian traders can invest with international forex brokers because trading overseas in Malaysia is also legal.

Can foreigners invest in Germany?

Yes. The trading laws of Germany do not make exceptions when it comes to foreign investors. However, you need to invest with a foreign broker who reports to your local tax authority.

How do I trade forex with $100 in Germany?

$100 is a fair amount to start trading with and can earn you profits. Start by having a strategic trading plan. Then, open a demo account where you can learn how forex trading works without risking your funds. Once you have enough forex trading knowledge, you can create a live account where you will deposit your $100 and monitor your trades.

Conclusion

You now must have an idea of what it takes to find the best stock broker. We believe that with this guide, alongside our recommended brokers, you will make informed decisions on the best brokers available in Germany. Remember that each broker has varying market assets and charges. So, before making a commitment, make sure that you put your trading needs into consideration.

Note: No information, nor financial advice related to online trading is offered through the comment.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS