Well, with intuitive thinking and software developers, trading in Nigeria has now been made easy. You can invest in both local and international brokers. And the best part is that you can also monitor your trading activities, and withdraw your profits anywhere, anytime.

We therefore took it upon ourselves to test and do extensive research on trading brokers in Nigeria. This is to simplify your search and recommend the best mobile trading apps in Nigeria, without being biased.

In This Guide

Here are the Best Mobile Trading Apps in Nigeria

- Best Trading App: AvaTrade

- Best App for Forex Trading: Forex.com

- Best Investment App: ARM Securities

- Best Trading App with a Low Minimum Deposit: HotForex

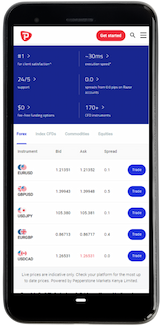

- Best Free Trading App: Pepperstone

- Best Trading App for Android: Markets.com

- Best Trading App for iOS: AvaTrade

Which is the Best Trading App in Nigeria?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

Based in Ireland, AvaTrade is considered to be one of the best trading apps globally. The app, AvaTradeGO, is by far the best for traders in Nigeria. With thousands of registered traders globally, AvaTrade is regulated by top-tier regulators, including ASIC in Australia and the FSCA in South Africa.

AvaTrade offers various instruments, including forex, commodities, stocks, cryptocurrencies, shares, and bonds. The broker also has a fixed spread account with a competitive spread.

AvaTrade does not charge deposit and withdrawal fees, which is a plus, compared to other brokers. AvaTrade is also commission-free when it comes to its retail account, making it among the top brokers with low trading charges.

Another plus point for AvaTrade is that it offers Muslim traders an Islamic account. The account is in line with Sharia law. Therefore, we advise you to try the AvaTrade demo account before committing yourself. We hope that your experience will be fascinating.

Which is the Best App for Forex Trading in Nigeria?

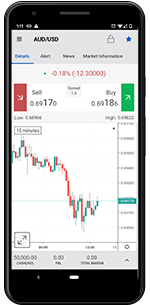

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com is a pioneer forex broker accepting Nigerian clients. It is by far ranked the best forex broker in the United States, meaning that it has exceptional trading features and functions. The leading U.S. regulatory authorities also regulate the broker, including the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC).

Forex.com has an efficient mobile application that includes MetaTrader 4 and 5 platforms. It allows Islamic accounts so that Muslims in Nigeria can also trade, without incurring swap charges.

Which is the Best Investment App in Nigeria?

ARM Securities has offered investment opportunities in Nigeria since 2004.

The broker provides access to both the Nigerian Stock Exchange as well as a number of international security exchanges.

✔ Well-established in Nigera

✔ Access to the Nigerian Stock Exchange

✔ Several accounts based on your needs

✔ Complicated fee system

✔ Expensive services

✔ Limited access to certain markets

✔ Well-established in Nigera

✔ Access to the Nigerian Stock Exchange

✔ Several accounts based on your needs

✗ Complicated fee system

✗ Expensive services

✗ Limited access to certain markets

Fees: Commission and fees

Demo account: No

Min deposit: N/A

Assets: Domestic and international securities

License: SEC

If you are looking for an investment app that allows you to trade locally and internationally, ARM Securities tops the list. Being a Nigerian-based securities broker, ARM Securities is listed on the Nigerian Stock Exchange (NSE).

ARM Securities started its operations in 2004 and has grown to be a premium online investment app in Nigeria. This broker’s offering includes analytic tools, market trends report, money management, local financial news, and professional investors’ assistance.

However, ARM Securities has a limited selection of securities that you can choose from. Simply put, it is the best investment app in Nigeria, but if you are looking for more variations, you may want to try other options.

Which is the Best Trading App with a Low Minimum Deposit in Nigeria?

✔ Numerous industry awards

✔ Negative balance protection

✔ Fast Account Opening

✔ Only Forex and CFDs

✔ Doesn't provide services to the USA and Canada residents.

✔ Numerous industry awards

✔ Negative balance protection

✔ Fast Account Opening

✗ Only Forex and CFDs

✗ Doesn't provide services to the USA and Canada residents.

Fees: Deposits and withdrawals are fee-free. Spreads and commissions are low, depending on account type.

Demo account: Yes.

Min deposit: $5

Assets: Great range of markets

License: FCA, DFSA, FSCA and FSA.

If you are a beginner in forex trading, looking for a broker with a low minimum deposit, you should consider HotForex. This broker is deemed safe by most Nigerian traders because of its licences from top-tier regulators, including the FCA, FSCA, and CySec.

HotForex has a low minimum deposit requirement of $5. Its fees are also low, making it a perfect broker for traders on a tight budget. The broker supports local Nigerian bank deposits and withdrawal methods. It also has wallet options. So, you don’t need to go through the hustles of currency exchange, which could cost you more.

HotForex has an application supported by both Android and iOS devices. This makes it easier for you to monitor your trading activities whenever you see fit. The broker also has bonuses and loyalty programmes for existing traders.

Which is the Best Free Trading App in Nigeria?

✔ Fast execution and low-cost trading

✔ One of the largest retail brokers

✔ Fast account opening with no minimum deposit

✔ US traders not allowed

✔ No guaranteed negative balance protection

✔ Fast execution and low-cost trading

✔ One of the largest retail brokers

✔ Fast account opening with no minimum deposit

✗ US traders not allowed

✗ No guaranteed negative balance protection

Fees: Low trading fees, non-trading fees, forex fees, no deposit fees.

Demo account: Yes.

Min deposit: $0

Assets: 150 financial instruments.

License: ASIC, DFSA, FCA, CySEC, CMA, SCB and BaFin.

Founded in 2010, Pepperstone is an Australian broker that has continued to grow over the years. It is regulated by the top-tier commissions, namely ASIC and FCA.

Since Pepperston has received its approval from the Nigerian Securities and Exchange Commission (NSEC) to operate in Nigeria, the broker seems to gain the local traders’ trust and be rated as the best free trading app.

Pepperstone costs are favourable, when compared to other brokers. First, the broker does not charge commissions on its standard account. You will only pay spreads depending on the amount of money you are buying or selling. However, when it comes to its razor account, you will be charged commission fees with very low spreads.

Pepperstone’s account opening procedure is straightforward and free. You also do not need to pay deposit and withdrawal fees with Pepperstone. This makes it the most preferred free trading app in Nigeria.

Which is the Best Trading App for Android in Nigeria?

✔ Perfect tools for learning and research

✔ Fixed spreads

✔ Commission-free accounts

✔ Not available for US clients

✔ Limited product portfolio

✔ Perfect tools for learning and research

✔ Fixed spreads

✔ Commission-free accounts

✗ Not available for US clients

✗ Limited product portfolio

Fees: High trading fees.

Demo account: Yes.

Min deposit: $250.

Assets: Large selection of assets including forex, commodities, shares and indices.

License: FMA, CySEC, FSCA and ASIC

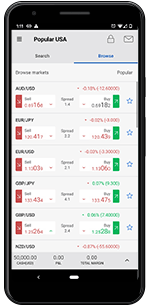

Markets.com is a global broker offering CFD, forex, and other derivatives for retail traders. Since it started operating in 2008, Markets.com continues to provide its users with various tools, including commodities, stocks, and ETFs.

Many Nigerian users prefer using Markets.com, especially when it comes to forex trading. This is because of its excellent user interface design. Its platform also allows you to use various instruments across different asset classes.

One thing that stands out about Markets.com is its impeccable customer service. Users feel safer with this broker, which has led it to earn multiple awards over the years. Markets.com has a premium account known as MarketsX. This account is only available for traders who deposit at least $250.

Since Markets.com’s app is the most preferred broker by Nigerian users, it has been rated as the best app for Android devices. It is easy to use and follow.

Which is the Best Trading App for iOS in Nigeria?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

Being the pioneer of cryptocurrency trading, AvaTrade allows currency pairs trading on its mobile application, AvaTradeGO. With a mobile-friendly user interface, AvaTradeGO will enable traders to access automated tools and robots, which makes it easier to monitor your trading activities.

AvaTrade’s charges are also favourable for traders who are on a low budget. It does not charge CFD trading account opening fees. Traders will also not incur deposit and withdrawal fees. However, when it comes to spread, AvaTrade will charge you when using real money. The broker also has a minimum deposit requirement after you create a live account on its platform.

Guide for Traders in Nigeria

Forex trading in Nigeria has become something that attracts both local and international brokers. With the technology change, trading has become even easier for Nigerian traders. The mobile apps give them the flexibility to invest and track their trades as they see fit.

With mobile apps, Nigerian traders can easily make deposits and withdrawals using local payment methods. Therefore, as a beginner in Nigeria, we recommend that you do your thorough research on a broker before committing.

Our recommended brokers are what you need to consider when searching for a broker in Nigeria. However, depending on your needs, you should look out for the following significant factors:

Trading laws

It is essential to understand Nigerian trading laws so that you may know the risks to avoid. Note that it is only legal to trade in Nigeria with a licensed broker. So, to avoid breaking the law, you must follow the rules.

Ensure that the broker is regulated by the Nigerian Securities and Exchange Commission (NSEC). Subsequently, all regulated brokers offering their services to Nigerian traders must get approval from the SEC and FCA in the UK.

Local Markets

Although trading is legal in Nigeria, it does not mean that all brokers will allow you to trade both locally and internationally. Some of them only enable international trade. For this reason, we advise that you do extensive research before committing to a broker.

Islamic trading accounts

More than 50% of the Nigerian population practice Islam. Therefore, it might be better for you to find a broker offering Islamic trading accounts. We take into consideration the religion of our readers, which is why our recommended brokers offer both Islamic and non-Islamic trading accounts, to prevent you from violating Sharia law.

Trading currency

Finding a broker that allows you to trade in Nigerian Naira should be of utmost importance. No trader likes the hustles of currency exchange that consumes time and money. Make sure the broker you choose allows you to make deposits and withdrawals using Naira. They should also let you trade with other currencies, such as the US dollar.

How to Choose the Best Trading App in Nigeria

Finding the best trading app in Nigeria can be challenging and overwhelming. The process of reviewing and testing brokers through demo accounts could seem as unending to most Nigerian traders. Worry no more because we are here to guide you through identifying the best trading apps in Nigeria.

Since there are numerous trading apps in the market, you must choose a trading app carefully. You will be able to focus on your more significant trading activities, instead of worrying about your investment safety.

Therefore, when choosing a trading app, look out for the following factors:

Security

For you to succeed in trading, it is essential to consider the security of your investment. The application you use should be of a licensed and regulated broker. If the broker is foreign, they should have a licence from the UK’s Financial Conduct Authority (FCA). They also must get approval to be a broker in Nigeria from the Nigerian Securities and Exchange Commission (NSEC).

Budget

Before even choosing a trading app, you must have a budget. This budget is what will guide you into selecting the best trading app that suits your needs. In general, brokers who offer forex and CFD trading are usually more affordable than the traditional securities investment brokers.

You will also find that some brokers require a minimum deposit amount and charge commissions, while others do not. It’s all about what suits your budget.

Trading platform

Find an app offering an attractive user interface. The app should also be user-friendly and allow you to invest and monitor your trades anywhere, anytime. It should have different trading functions that align with other strategies.

The best trading app should allow you to learn along the way. After all, one of the main reasons to start trading is to learn and hopefully, be an expert. It should have educational content that helps to improve your experience.

Customer support

A good and reliable broker should have dedicated customer support, where you can air your trading issues. Not only do brokers need to have customer support, but it must be reputable. With excellent customer support, you will have a better understanding of what they offer. The app must also be able to provide its activities in your language.

Payment methods

It will suit your trading needs if you also consider the mode of payment and withdrawal before committing yourself to a particular broker. First, the broker should allow you to make deposits and withdrawals using the Naira currency.

Second and lastly, they should accept the Nigerian payment methods. We ensure that our recommended brokers accept local payment methods, so you don’t have to go through the currency exchange hustle.

FAQs

Is forex trading legal in Nigeria?

Yes. Nigerian traders are free to invest with both local and international brokers. Note that these brokers must be licensed and regulated by the relevant regulatory authorities.

How do I trade stocks in Nigeria?

First, you need to work out your budget. Then, choose a suitable stock broker in Nigeria that suits your interests. You can find these brokers in our review above.

Do forex traders pay tax in Nigeria?

While traders in Nigeria are only allowed to invest with regulated brokers, this activity is considered a business. For this reason, they are liable to pay tax.

How can I invest in Nigeria?

You need to be 18 years and above to qualify for online trading. Find the best broker that suits your needs and create a trading account. Note that you will require the necessary skills and knowledge to succeed. With this investment account, you will access different assets in countries such as the US, UK, and Nigeria. The choice is yours.

Can I trade forex with $10 in Nigeria?

Absolutely! Because most brokers in Nigeria do not require a minimum deposit to start trading, you can trade forex with as little as $10.

How much do forex traders make a day?

There is no specific amount that forex traders make in a day. Some days are good, while others aren’t. It all depends on the asset’s volatility and the margin rate which the broker has offered.

Are trading apps safe?

Yes. If you invest with a licensed and regulated broker, you don’t need to worry about your safety while using their mobile trading app. We make sure that our recommended trading apps secure your information.

Conclusion

Now that you know the best trading apps in Nigeria, it’s time to make a change and start earning some extra cash. With these apps, you will be in control of your investment and hence grow your portfolio. All of our recommended brokers are licensed and regulated by the top-tier authorities, so you don’t need to worry about safety.

Note: Our customers’ feedback is what encourages us to make this platform a better place. Should you have any comment or question that crosses your mind, while spending time on our website, we encourage you to leave a message below. We promise to get back to you promptly.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS