We’ve done a tremendous job and spent countless hours researching trading apps to find the best of the best for you. With our list, you can be sure to find the right and reliable mobile trading app in Canada that you can use for many years to come.

In This Guide

Here Are the Best Mobile Trading Apps in Canada

- Best Trading App in Canada: Interactive Brokers

- Best Investment App in Canada: TD Direct Investing

- Best Trading App with a Low Minimum Deposit in Canada: Forex.com

- Best Free Trading App in Canada: CMC Markets

- Best Forex Trading App for Beginners in Canada: Oanda

- Easy to Download Stock Trading App in Canada: QTrade Investor

- Best Trading App for Android in Canada: Forex.com

- Best Trading App for iOS in Canada: Interactive Brokers

Which is the Best Trading App in Canada?

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✔ Long processing time for withdrawls

✔ High commission for small positions

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✗ Long processing time for withdrawls

✗ High commission for small positions

Fees: Rather high fees

Demo account: Yes

Min deposit: $100

Assets: Huge selection

License: SEC, IIROC, FCA, ASIC

Interactive Brokers, or IBKR, has a long history of breaking ground on Canada’s international trading market. Over the past few years, IBKR has done a great job to please us with one of Canada’s best trading apps. Their mobile app offers various services, including investing and trading securities such as futures, stocks, bonds, ETFs, and more.

Moreover, IBKR is considered the best trading app in Canada due to the huge selection of trading instruments and low fees, which is an undoubted advantage.

At the same time, we faced the fact that some users are not satisfied with the customer service. Moreover, some clients have complained that they cannot open and close positions to claim their profits.

These two things should be considered before choosing a trading application in Canada.

Which is the Best Investment App in Canada?

✔ More than 30 years of experience in Canada

✔ Closely connected to TD Bank and TD Ameritrade

✔ Only for Canadians

✔ High commission

✔ More than 30 years of experience in Canada

✔ Closely connected to TD Bank and TD Ameritrade

✗ Only for Canadians

✗ High commission

Fees: Commission and non-trading fees

Demo account: No

Min deposit: N/A

Assets: A mix of domestic and international securities

License: IIROC

After countless hours of testing and reviewing, we’re convinced that TD Direct Investing is the best investment app.

The handy TD app lets you customize your home screen to quickly and easily access your investment tools. What’s more, free real-time snap quotes help you get the most out of your business.

The wide range of stocks and securities makes TD Direct Investing the best choice for investment.

Unfortunately, many of the app’s features have a high price, including investing that requires paying a commission. Moreover, some users claim that TD Ameritrade’s original product is more effective.

Which is the Best Trading App with a Low Minimum Deposit in Canada?

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com provides many opportunities for convenient trading on the Forex markets in Canada. The broker offers one of the best trading platforms, analytical tools, training materials, and trading apps on the market.

The minimum deposit for trading on Forex.com is $100.

Moreover, powerful charting tools and over 80 technical indicators make the trading application one of the most multifunctional and convenient for serious traders.

On the other hand, the selection of assets on Forex.com is somewhat limited in Canada.

Which is the Best Free Trading App in Canada?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

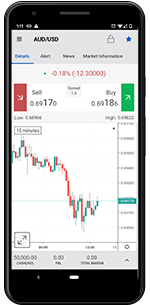

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC Markets is a versatile trading app that is perfect for both novice and experienced users. Both traders and investors have the opportunity to use mobile trading software, which includes a convenient and profitable investment program.

Everyone can start their acquaintance with CMC Markets using a free demo account and downloading the app absolutely free.

In addition to being commission-free for deposits and most withdrawals, CMC Markets have competitive fees.

While CMC Markets mobile app is considered suitable for traders of all levels, many beginners claim that it is difficult for inexperienced users.

Which is the Best Forex Trading App for Beginners in Canada?

Oanda is one of the world’s most elite online brokers based in New York and with a global reach that few brokers can compete against.

✔ Their unparalleled global reach

✔ 5 different platforms

✔ High fees and commission

✔ A limited selection of assets in some jurisdictions

✔ Their unparalleled global reach

✔ 5 different platforms

✗ High fees and commission

✗ A limited selection of assets in some jurisdictions

Fees: Commission, fees, and spread depending on the assets/securities

Demo Account: Yes

Min Deposit: 0

Assets: Thousands

Licenses: (CFTC), (FCA) & (IIROC)

Oanda is the best mobile trading app for novice traders in Canada. The trading application is easy to use, has a simple interface, and more than 50 useful technical tools.

Oanda offers a variety of helpful educational materials allowing traders to move to the next level. You can find written and video materials in the application, and it has its own courses and webinars.

Unfortunately, due to Canada’s strict trading laws, the app has a limited selection of assets in the trading market.

Easy to Download Stock Trading App in Canada

✔ Huge selection of securities

✔ Have won multiple awards over the years

✔ Only available to Canadian customers

✔ Complicated pricing system

✔ Huge selection of securities

✔ Have won multiple awards over the years

✗ Only available to Canadian customers

✗ Complicated pricing system

Fees: Commission and fees (first 100 ETFs are commission-free)

Demo account: No

Min deposit: N/A

Assets: US, Canadian, and international securities

License: IIROC

Qtrade Investor is a local stockbroker in Canada. We consider it the best based on users’ reviews and opinions of Globe and Mail, which have already mentioned it as the best in Canada.

Qtrade provides the ability to trade all available securities in Canada: Canadian Mutual Funds and fixed income products such as bonds and GICs.

Please be aware that Forex, CFDs, or cryptocurrencies cannot be traded on the app. Besides, Qtrade Investor charges relatively high non-trading fees

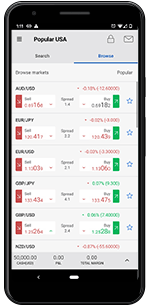

Which is the Best Trading App for Android in Canada?

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com is one of the largest virtual trading platforms, not only in Canada but around the world. Online Forex and CFD broker have a convenient and effective trading application for Android.

After opening a Forex.com account and installing the application on your Android, you will receive full trading capabilities, advanced charts, and integrated trading tools.

Forex.com trading app for Android also has 26 indicators and 13 drawing tools. Moreover, scrolling between quotes, charts, and current positions takes only a few seconds, which is an undoubted advantage.

Which is the Best Trading App for iOS in Canada?

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✔ Long processing time for withdrawls

✔ High commission for small positions

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✗ Long processing time for withdrawls

✗ High commission for small positions

Fees: Rather high fees

Demo account: Yes

Min deposit: $100

Assets: Huge selection

License: SEC, IIROC, FCA, ASIC

Interactive Brokers virtual trading app offers access to over 100 market centres in 24 different countries.

The IB mobile app for the iPhone has a user-friendly interface that uses Key technology, so you need to enter a PIN or swipe as an extra security measure.

Interactive Brokers trading app is easy to use — you get the same selection of indicators, only with a cleaner interface.

The downside of the application is the lack of access to complex tools or interfaces for specific venues, such as FX Trader.

Trading Guide for Traders in Canada

Before moving on to the essential tips for finding trading applications in Canada, we would like to emphasize the importance of trading rules in the country.

As Canada is famous for its various restrictions and strict trading rules, obtaining broker licenses becomes very difficult. On the other hand, it makes the trading market safe for investors.

The Investment Industry Regulatory Organization of Canada (IIROC) is the national self-regulatory organization that maintains control of overall investment and trading opportunities around the country. Canadian Securities Administrators (CSA) protects Canadian investors from unfair, improper, or fraudulent. Their goal is to improve and coordinate the Canadian capital markets.

It is also worth considering that each province has a regional securities regulator. Provincial or territory regulators handle all complaints of stock trading violations, thus ensuring a more efficient trading market.

For example, if you are a Quebec resident looking to start trading, the best solution would be to contact your local securities regulator – Autorité des Marchés Financiers (AMF). They will help you find out the information you need about taxes and how and what you can trade.

How To Choose The Best Trading App

Choosing the best trading application in Canada is a decision based on the personal preference of each trader. Nevertheless, when choosing, keep in mind some important things.

Of course, application security comes first: only those trading applications that are licensed and regulated should be considered.

It is also important to choose a trading application according to your knowledge level: a good trading application should have educational materials useful for both beginners and experienced users.

Make sure the trading application supports the securities you intend to trade.

You can also check out our list of the best trading apps, as we took all of the above into account when testing the apps. In fact, we spent hours picking the best of the best.

FAQs

Is day trading legal in Canada?

Day trading in Canada is legal, although it is associated with high risk. Day trading in Canada has many restrictions regulated by IIROC around the country and regional securities regulators in each province.

Can I buy stocks in Canada?

Yes. You can buy any Canadian stock.

In fact, you can invest in a range of domestic and international stocks. The best way to purchase stocks in Canada is through an online broker or your bank.

How do I start buying stocks in Canada?

In order to buy stocks in Canada, you need to choose a suitable broker. After determining which account you want to open, set up a deposit schedule. By funding your investment account, you can choose the stocks you want to buy. Be careful and analyze each instrument before buying stocks.

How do I start investing in Canada?

If you want to start investing in Canada, you need to choose the right broker and decide on your investment strategy. The best investing strategy is the one that allows you to get the maximum profit with the minimum risk.

You also need to be sure that you are ready for the potential risk. Analyze the market and securities carefully and invest only if you’re sure that it’s the right decision.

Are online trading apps safe in Canada?

The main regulators carefully regulate the buying and selling of shares in Canada: Investment Industry Regulatory Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). When choosing a trading application, be sure to pay attention to the broker’s license. All licensed brokers are properly regulated in Canada and are completely safe.

Is Robinhood app available in Canada?

Unfortunately, Robinhood is not yet available in Canada. Robinhood is available for trading in the United States (US) and only to US citizens. If you are not a resident of the United States, then you are prohibited from buying and selling securities in any way.

Can I buy stocks without fees?

Yes, you can buy stocks without fees. You can choose commission-free platforms with low-minimum deposits. But to get more profit, you need to get better tools, which can require some money.

Conclusion

We hope that the work we have done will be useful for traders looking for a suitable mobile trading application in Canada. Our trading app guide will make your search easier.

Note: Don’t hesitate to leave a comment below in case you have any questions regarding trading apps, safety, day trading, investments, financial systems, or anything else that might come to mind while spending time on our website. We promise to answer you as soon as possible.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS