Germany is a member of the European Union (E.U.) with easy access to trading markets, globally. The markets offer extensive brokers with excellent trading apps. Most of these apps provide a plethora of instruments, securities, and derivatives to trade with.

If you are new to the trading industry, you need to find an intuitive investment app with multiple resources and educational tools to learn and improve. The app should also have offerings that are in line with your trading needs.

Here, we have listed several trusted brokers. We have gone above and beyond by conducting hours of research and testing to make sure that we recommend the best, without being biased.

In This Guide

Here are the Best Mobile Trading Apps in Germany

- One of the Best Trading Apps: Plus500

- Best Investment App: Interactive Brokers

- Cheapest Stock Trading App: Interactive Brokers

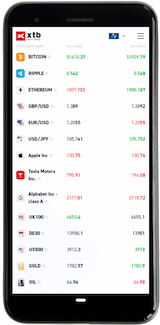

- Best Trading App for Android: XTB

- Best Trading App for iOS: CMC Markets

Which is one of the Best Trading App in Germany?

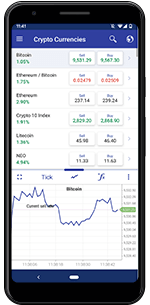

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Plus500 is a global broker that offers online traders an easy-to-use trading platform for trading CFDs on commodities, forex, ETFs, indices, options, and shares. The broker was founded in 2008 and has grown to be one of the best CFD brokers worldwide.

Plus500 serves clients in more than 50 countries and is regulated by top-tier authorities, such as the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC).

The app has a well-designed mobile platform with easy-to-use features. Its account opening procedure is also seamless and it only takes a few hours to be verified. Plus500 also boasts of its responsive customer support at your beck and call, should you have any questions or concerns.

While the broker offers commission-free services, it also charges inactivity fees, making it a suitable app for frequent traders, overnight, and currency (in some cases) fees.

Which is the Best Investment App in Germany?

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✔ Long processing time for withdrawls

✔ High commission for small positions

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✗ Long processing time for withdrawls

✗ High commission for small positions

Fees: Rather high fees

Demo account: Yes

Min deposit: $100

Assets: Huge selection

License: SEC, IIROC, FCA, ASIC

Interactive Brokers, also known as IBRK, is a US-based broker that was founded in the 1970s. It is regulated by several authorities, including top-tier ones like the Financial Conduct Authority (FCA), Securities and Exchange Commission (SEC), and the Federal Financial Supervisory Authority (BaFin).

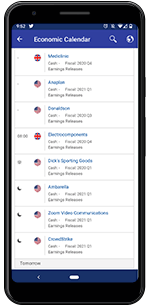

With these multiple licenses, many traders consider it safe. The app offers various market assets with all types of products. This is why it is rated the best investment app in Germany. It also has many research and educational tools that help you to improve your trading experience.

Interactive Brokers trading charges are low and do not have a minimum deposit requirement. The broker also does not charge deposit fees and the first withdrawals every month are also free. However, IBRK charges a relatively high inactivity fee. So, if you are a frequent trader, this trading app is what you should consider.

Although the broker only allows bank transfers for withdrawals, it offers various currencies for trading, including euro. This benefits German traders because you don’t need to go through the hustle of currency exchange. The app’s platform is also user-friendly and straightforward, which makes it an easy-to-use tool for beginners. It also comes with many functions and a useful chatbot in various languages, including German.

Which is the Cheapest Stock Trading App in Germany?

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✔ Long processing time for withdrawls

✔ High commission for small positions

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✗ Long processing time for withdrawls

✗ High commission for small positions

Fees: Rather high fees

Demo account: Yes

Min deposit: $100

Assets: Huge selection

License: SEC, IIROC, FCA, ASIC

Interactive Brokers is regulated by the best authorities, including the Federal Financial Supervisory Authority (BaFin) in Germany. The broker’s stock trading fees are low, which benefits traders who invest frequently. Its margin rates are also low, proving beneficial to your trading costs. Margin rates are charges you incur while trading on margin. This means that you trade using borrowed stocks or money from your broker, after which you pay with interest.

The app account opening procedure is fully digital. It also offers various research tools that can be helpful to improve your trading experience.

IBRK has its drawbacks, however. The forex charges are high and its desktop platform is also challenging to use, especially for novice traders.

Overall, this stockbroker is best suited for experienced stock traders. The user-friendly app with low trading costs suits your everyday trading needs.

Which is the Best Trading App for Android in Germany?

✔ Easy to use, fully customisable

✔ Superior execution speeds

✔ Trader's calculator, performance statistics, sentiment

✔ High fees for stock CFDs

✔ Product portfolio limited mostly to CFDs and FX

✔ Limited fundamental data

✔ Easy to use, fully customisable

✔ Superior execution speeds

✔ Trader's calculator, performance statistics, sentiment

✗ High fees for stock CFDs

✗ Product portfolio limited mostly to CFDs and FX

✗ Limited fundamental data

Fees: Spread cost; Commissions; overnight financing costs; inactivity fees.

Demo account: yes.

Min deposit: $0.

Assets: huge selection.

License: IFSC, FCA, KNF, CySEC, DFSA.

XTB is a Warsaw-based global FX & CFDs broker that was founded in 2002. The broker is also considered safe by traders because it is regulated by top-tier regulators, including the Financial Conduct Authority (FCA). XTB’s forex fees are low. Withdrawal fees are free above 50GBP. However, the broker’s stock trading fees are relatively high. It also charges inactivity fees. So, to commit, you must be an active trader.

XTB is one of the trading apps with a modern design and great search functions. The app is also available in all languages, including German. Simply put, the same procedures you find on its trading web platform, are the same functions you will get in the app. The only difference is that the app is flexible, and you can access it anywhere, anytime.

Apart from the look and feel, you can also access the essential features easily. The account opening procedure for this broker is so straightforward that even beginners won’t hustle. The best part is that the verification process is also fast and takes less than 24 hours.

Unfortunately, the broker does not offer popular asset markets, such as mutual funds, options, futures, and bonds. Therefore, since it mostly suits CFD and forex brokers, we advise that you familiarise yourself with how CFD works (complex instruments with a high risk of losing money) before choosing this app.

Which is the Best Trading App for iOS in Germany?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC Markets is one of the pioneers of CFD and forex trading globally. Founded in 1989, the broker continues to update its features to ensure that traders receive the best experience. CMC Markets is a safe broker because it is regulated by top-tier authorities, such as the Financial Conduct Authority (FCA) and the Financial Federal Financial Supervisory Authority (BaFin).

CMC Markets’ trading app has user-friendly features that offer a variety of order types. The app’s platform is well-structured, making it easy for you to find all the features. The search function is also impeccable, whereby when you type in a product, it shows related assets for quick navigation. Additionally, it also allows you to set alerts or notifications so that you can stay abreast with your trading activities.

Do not hesitate to try the CMC Markets app on your iOS device. You will not only enjoy its user-friendly features, but you will also get access to educational and research tools that will help you improve your trading experience.

Guide For Traders in Germany

Whether you are a beginner or an expert investor looking for a broker, you need to consider some factors. Note that trading is not just about investing and earning profits. You must first consider your safety. Below, we have summarised some of the primary factors you need to know about, before entering the trading market.

Laws/Regulations

All eligible Germans (above 18 years) are allowed to invest with a regulated broker for as long as the broker is approved and overseen by the Financial Federal Financial Supervisory Authority (BaFin) and other top-tier authorities, such as the Financial Conduct Authority (FCA). This factor assures you of your investment’s security so that you can entirely focus on trading.

Market availability

Not all brokers will let you trade locally and internationally. Depending on your needs, we advise you to choose a broker with access to your local exchange market. For example, if a U.S. citizen wishes to access the U.S. exchange market, they should find a foreign broker who reports to the U.S IRS.

Currency

Do not hustle trying to find a broker offering different currencies when there are a variety to choose from in this guide. Our recommended brokers not only allow you to deposit in euros, but they also allow you to trade using other currencies, such as the U.S. dollar.

How to Choose the Best Trading App

Before you commit yourself to a broker, we advise that you conduct thorough research to make informed decisions for your trading needs. We understand that finding a good trading app can be challenging, since you require an app that is flexible and useful all the time. To guide you in your choices, below are the factors to consider when choosing a trading app.

Security

The best app must secure your investments and personal information. You do not want to invest your money with a broker who ends up being a fraudster. The broker should be licensed and regulated by reputable commissions. The Federal Financial Supervisory Authority (BaFin) should also oversee their activities.

Trading platform

Finding an app with a good trading platform that is easy-to-use and intuitive is another essential factor. You need to trade, monitor your activities, and receive notifications as they arise. The platform should also be available in different languages, including German.

Customer support

Novice traders need guidance during their first trading adventures. Therefore, we strongly recommend that you consider a broker with reliable and reputable customer service. The customer support should be available 24 hours every day, so that whenever you need clarification or have questions, there is a platform to contact.

FAQs

Is forex trading legal in Germany?

Yes. Germans are free to trade with a broker that is licensed and regulated by top-tier authorities, such as the Financial Conduct Authority (FCA) and the Securities Exchange and Commission (SEC). The brokers should also be approved and overseen by the Federal Financial Supervisory Authority (BaFin).

Where can I buy stocks in Germany?

Buying stocks in Germany is easy if you have a reliable stock broker. You can refer to our review above for recommendations. Confirm if your budget is within what the stock broker is offering. Once you create an account, then you are free to invest in stocks.

Can I buy U.S. stocks in Germany?

Yes. However, you need to find a safe broker that has access to the U.S. markets and reports to the U.S IRS.

How can I buy stocks in Germany?

The best way to buy stocks in Germany is through exchange-traded funds (ETFs). You can purchase the securities on the U.S. stock exchange, where they offer various companies.

Can foreigners invest in Germany?

Yes. There are various brokers allowing foreigners to invest in Germany. Make sure that the broker you choose is licensed and regulated by reputable commissions. They should also have approval from the Federal Financial Supervisory Authority (BaFin).

Is there a tax on forex trading?

Yes. Like any other business in Germany, the profits you earn from forex trading must be subjected to taxation. However, there are other countries, such as the United Arab Emirates, where forex trading assets are tax-free.

How difficult is forex?

Forex is not difficult if you have the right mindset. Most traders believe that they will immediately start making profits once they begin trading forex. Learn to be patient, and take losses as a learning process for success.

Conclusion

Now that you are well versed in the best trading and investment apps in Germany, it is time to give them a try. With so many brokers in Germany, we believe that you now have the necessary tools to make the right choices.

Consider our recommended forex brokers since they are among the safest in the market. In case you have doubts about your choice, remember that you can always try a demo account first.

Note: We value our customer’s feedback and encourage you to leave a message below. It could be a question or comment about trading apps, investment, safety, or anything else concerning our website. We promise to respond promptly.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS