Our team of crypto trading experts has spent well over 150 hours on testing, reviewing, and evaluating all the brokers and have created a list of the top crypto brokers in the UK.

In This Guide

Our List of the Best Cryptocurrency Brokers, Exchanges & Platforms in the UK

- Best Platform With Cryptocurrency Derivatives on Offer: CMC Markets

- Best Crypto Platform for Automated Trading: AvaTrade

- Best Crypto Trading Platform for Advanced: Forex.com

Which is the Best Platform With Cryptocurrency Derivatives on Offer in the UK?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC Markets allows all their customers to benefit from the highly-volatile cryptocurrency market. With a total of 12 cryptocurrencies that are traded against the USD, you can apply your derivatives trading skills to the world’s newest market.

This broker does not have a wallet and all cryptocurrency trading is done using derivatives similar to trading stocks as CFDs.

In addition, you can trade cryptos using CMC Markets with the two desktop platforms or the incredible mobile trading software.

Not sure which platform or broker will suit you better? Register a CMC Markets demo account today and test it out for yourself.

Which is the Best Crypto Platform for Automated Trading in the UK?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

AvaTrade has been spearheading the online crypto trading market for quite some time.

With a solid selection of the most popular cryptocurrencies as well as great platforms, both on desktop and mobile, this broker is an excellent choice for anyone wanting to speculate on the digital currency market.

Sign up with an AvaTrade account to gain access to 8 cryptocurrencies including EOS and Bitcoin Gold, which most brokers do not offer at the moment.

In our opinion, AvaTrade is best experienced through their trading apps but it’s up to you, trading cryptos with MT4 and AvaTrade is also a great experience.

Which is the Best Crypto Trading Platform for Advanced in the UK?

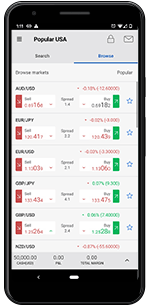

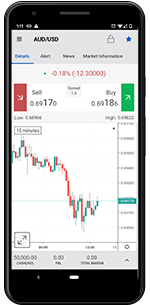

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com does not have the biggest selection of cryptocurrencies on the market but they do have two of the best platforms as well as a reputation of belonging to the best of the best.

There are currently 8 cryptocurrencies offered on Forex.com’s platforms and you have the option of quickly choosing between going short or long since. Although, right now you can only go short on BTC and ETH.

Better yet, Forex.com has incredibly fair spread on cryptocurrency trading, meaning you don’t have to pay as much to trade as you would with other broker and exchanges.

Moreover, Forex.com is owned by the massive American financial firm called Gain Capital that also operates City Index.

Trading Guide Cryptocurrency Trading Platforms UK

Cryptocurrency Trading UK is something most platforms offer today. The platforms listed above are all great trading platforms for cryptocurrencies, however, here at BullMarketz, we have reviewed and listed a lot of different brokers.

Most of them offer crypto but also other assets.

Below is a list of the best trading platforms available in the United Kingdom.

Trade Cryptocurrency UK:

- All of our recommended brokers in the UK have a license from the FCA or the CySEC which means they are able to operate in the UK. Both agencies are very strict and getting a license from them is not easy, and therefore you can trust the companies that have gone through the process.

- Most brokers offer between 3 and 10 cryptocurrencies. Bitcoin, Ethereum, XRP, and Litecoin are almost always offered.

- CFD trading on cryptocurrencies is a simple way to buy and sell crypto without unnecessary hassle. Though you need to be aware there will be some costs, as always, fees are a necessary evil.

While there are many brokers who offer cryptocurrencies, the 5 brokers listed on this page are our top picks.

We recommend that you check these brokers out if you are interested in trading cryptocurrencies, but first a little background information on the cryptocurrency market.

How to Choose Bitcoin Trading Brokers?

The brokers we are listing here are offering Bitcoin, Ethereum, XRP, EOS, Litecoin, Bitcoin Cash and usually even more cryptocurrencies. Though we recommend that you check out each broker individually.

Most brokers are offering the 5-10 biggest cryptos, however some brokers are offering much more than that.

Which cryptocurrencies do you want to trade?

Make sure the broker you are looking at is offering those. This you can learn either from our reviews or by visiting the brokers directly.

Pros and Cons of Crypto Trading

In 2009, Bitcoin became the first official cryptocurrency to be launched, making the cryptocurrency market one of the youngest financial markets in the world. Yet, the market has grown tremendously in popularity over the past 10 years and today, there are thousands of assets available.

Originally, cryptocurrencies were traded using exchanges and wallets where the investor bought the actual asset. This type of investment is still available and popular today, however, more and more traders are opting to trade cryptos as derivatives.

Is Cryptocurrency Trading Safe?

That is a very good question with a slightly complex answer. Generally speaking, cryptocurrency trading is safe as long as you know what you’re doing and only use regulated brokers. In case you don’t use a regulated broker, chances are that you will get ripped off and even have your funds stolen.

Therefore, we advise you to only use brokers that have been recommended by us since they are all regulated and licensed by the UK’s leading financial regulatory bodies. We talk more about cryptocurrency trading regulation further down.

With that being said, all forms of trading are associated with certain risks, mainly the risk of placing bad trades and losing your invested funds. This is the reality and a risk that we all have to accept when we start trading. Although, by learning how to trade, using a good and tested strategy, and continuously improving your knowledge, you can limit this risk.

Keep in mind that even the best cryptocurrency day traders that make a living from trading lose money at times and that there is no guarantee that will protect you from the occasional loss. Also, you will likely be losing more than you gain when you first get started so you need to be patient.

What Is the Main Difference Between Buying and Trading Crypto?

One of the biggest differences is that when you buy Bitcoin or any other cryptocurrency with an exchange you will actually own that cryptocurrency and you also have to store it somewhere safe.

When you trade with a broker, you do so through CFDs, and you don’t actually own the cryptocurrency. Instead, you enter into a contract with the broker.

The contract will state how much the currency is worth at that time, and once you sell it your profit is determined by the spread. We would argue that it is less hassle to trade a cryptocurrency than to buy it and store it.

Another key benefit of trading is that the brokers you will be trading with are regulated by the FCA and thus safe to trade with compared to exchanges that, in some cases, are unsafe and unreliable. Every week there is a new exchange hack, and they get worse and worse each time.

Cryptocurrency Exchanges in UK

What about cryptocurrency exchanges and wallets? Well, this guide wouldn’t be complete without us mentioning cryptocurrency exchanges and wallets.

Even though we always recommend that you trade your cryptos using an online broker, there are some limitations to that. For example, in case you want to buy the cryptocurrencies as an investment or use them as currencies, as they were originally intended to be used, you can’t use a broker.

Unlike a cryptocurrency broker, an exchange allows you to buy any cryptocurrency you want to either keep as an investment, trade with other instruments, or store and use as a form of payment. Below, we have listed the best cryptocurrency exchanges in the industry for your convenience.

Note: In case you’re planning on storing your cryptocurrencies for a longer period of time, cryptocurrency exchanges aren’t optimal. Instead, you need to store them and your private keys in a safe wallet or preferably a cold storage (offline wallet) such as the Trezor.

Licensed and Regulated trading platforms

Again, and just to round off this article about crypto trading platforms UK and exchanges.

We like the idea of both, though we prefer and recommend using a licensed broker. We generally recommend our users to stay away from unregulated exchanges and brokers.

Note: Don’t hesitate to leave a comment below in case you have any questions regarding trading apps, safety, day trading, investments, financial systems, or anything else that might come to mind while spending time on our website. We promise to answer you as soon as possible.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS

I am interested in investing in cryptocurrencies long term. What broker is the best?

Hey Jod,

If you are looking to invest in crypto for the long haul we suggest that you use an exchange rather than a broker. A broker is best to use when it comes to day trading cryptocurrencies. Invest long term then you are better off with an exchange, there will be a little bit more fees upfront but fewer fees long term.

// BM

Broker vs. Exchange?

Hi,

Please see the answer above, it really depends on what you are looking to trade.

// BM

This is very dependant on what your goal is, an exchange might be the best option if you are looking to HODL, and hold cryptos for a long time. While a broker is superior when it comes to day trading cryptocurrencies.

It seems that most of these platforms have a very limited amount of crypto available.. not very suitable for those that want to trade on lesser-known coins.