More and more South Africans are turning to online investment in the stocks markets to boost their income. The majority of these investors learn trading on their own and do not fully understand the risks that come with stock trading. To trade safely, you need to identify a trusted broker with the best trading platform.

So, how do you find the best stock trading platform in South Africa? The easiest way is to rely on our unbiased reviews of all the top trading platforms and online stock brokers in South Africa. That way, you know you’ll find a good and reliable broker that you can use for many years to come.

In This Guide

Here are the Best Stock Brokers & Platforms in South Africa:

- Best Trading Platform: IG Markets

- Best Share and Stock Trading Platform: IG Markets

- Cheapest Online Trading Platform: Forex.com

- Cheapest Share Trading Platform in South Africa: IG Markets

- One of the Best CFD Trading Platforms for Stocks: Plus500

Which is the Best Trading Platform in South Africa?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

Since its establishment in 1974, IG Markets has grown to be one of the biggest CFD brokers globally. It is also known to be one of the safest because it is regulated by top-tier financial authorities, including the UK’s Financial Conduct Authority (FCA) and South Africa’s Financial Sector Conduct Authority (FSCA).

The broker boasts of excellent trading platforms and research tools. It offers a wide range of features, with flexible functionalities to serve both the novice and experienced traders. These features are what makes IG Markets outshine other brokers as the best trading platform in South Africa.

Trading on this platform, you will find many tradable assets, including stocks, commodities, forex, indices and cryptocurrencies. You can use the asset classes to trade CFDs and spread. Note that IG Markets has competitive spread charges and no commissions on non-stock CFDs. On the downside, its forex and stock CFD are relatively high.

If you are looking for a trading platform with various educational resources, then IG Markets is the broker for you. The educational resources available on its trading platform are in written or video form. It also has quizzes you can partake in to track your trading progress.

Do not hesitate to try IG Markets’ trading platform using the demo account. Even though it is primarily recommended for experienced stock traders in South Africa, novice investors can also give it a try, should they feel confident in their trading strategies.

Which is the Best Share and Stock Trading Platform in South Africa?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

Again, IG Markets tops the list as the best share and stock trading platform in South Africa, according to our research. Since it is regulated by tier-one authorities, you do not need to worry about your investments’ safety. Its share dealing services include more than 10,000 equities, investment trusts, and funds listed on various stock exchange markets.

If you are an experienced investor in stocks and shares, the broker has a L-2 dealer platform for you. On this platform, you will be able to gain Direct Market Access and directly place your trades on order books of stock exchanges.

The broker’s stock and share trading platform is easy to use for both beginners and expert traders. You can quickly improve your trading experience with IG Markets since it also has various educational tools. The mobile trading platform for this broker is also comprehensive, with excellent functionalities.

Feel free to try IG Markets’ trading platform using its demo account. With $20,000 virtual funds, you will be able to develop your trading skills before creating a live trading account.

Why Forex.com is the Cheapest Online Trading Platform in South Africa

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com has morphed into one of the most popular and highly regulated brokers globally. It is known as the biggest MT4 broker globally, with a trading platform that supports more than 80 forex pairs. Forex.com also offers various market securities, including CFDs and cryptocurrencies.

When it comes to Forex.com’s fees, it does not charge deposits and withdrawals. There are also no trade commissions, and it has one of the lowest cryptocurrency trading costs. Although it’s stock CFDs fees are high, it still ranks as the cheapest online trading platform in South Africa.

Forex.com also has a trading app with a platform that is integrated with live Reuter news. That way, you will not only be able to monitor your trading activities, but you will also be kept up to date with the latest developments in the trading market.

If you are an active trader, Forex.com offers three different flexible trading accounts. They include standard, commission and Direct Market Access. With these accounts, you can leverage by borrowing money from the broker to trade. For novice investors, you can use the demo account to hone your trading skills before making a decision to create a live trading account.

Which is the Cheapest Share Trading Platform in South Africa?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

One of the reasons why IG Markets stands out as the cheapest share trading platform in South Africa is because of its offerings of more than 17,000 shares. The broker is not an all-round free share trading platform. Instead, it has competitive spread charges and no commissions on non-stock CFDs.

Founded in 1974, IG Markets is one of the pioneer CFD brokers globally. It is also considered a safe share trading platform because it is regulated by tier-one financial regulators, including the Financial Conduct Authority (FCA). Its services in South Africa are also overseen by the Financial Sector Conduct Authority (FSCA).

With no commission on share trading and various tools on research and education, IG Markets outshines other share brokers in South Africa. It also offers its traders with larger accounts the opportunity to trade CFD shares through L2 Dealer. The advantage of using an L2 dealer is that you get Direct Market Access (DMA) where you directly place your trades on order books of stock exchanges.

On the downside, the broker’s trading platform forex and stock CFD fees are relatively high. However, it is all worth a try when you take advantage of the available trading tools. IG Markets has a demo account, which you can take advantage of and try the big selection of market offerings. Note that this account is free to use, with virtual funds. Therefore, you cannot make profits with it.

Which is One of the Best CFD Trading Platforms for Stocks in South Africa?

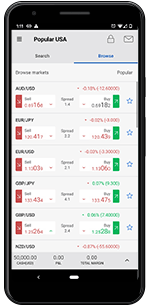

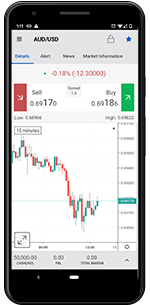

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

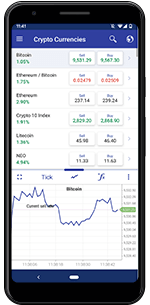

Since 2008, Plus500 continues to offer a wide range of CFD financial markets to its customers. It is a trusted global brand, regulated by top-tier monetary authorities, including the Financial Conduct Authority (FCA) and the Financial Sector Conduct Authority (FSCA).

The broker’s CFD financial instruments include forex, stocks, and cryptocurrencies. It charges no commissions on trades and its spread fees are also low. When it comes to non-trading charges, you incur zero costs when making deposits and withdrawals. On the other hand, Plus500 charges inactivity fees, should you fail to log in to your account for three months. It also has overnight, and currency (in some cases) fees.

Plus500 has an intuitive design trading platform that is easy-to-use and customisable. You can create a live account at the cost of $100 minimum deposit, which is low compared to other brokers with higher requirements. South Africans can easily make payments using bank transfers and e-wallet, such as PayPal.

Like any other broker we recommend, Plus500 has a demo account to experiment on. With more than 2,000 CFDs, this CFD trading platform allows you to explore the trading market before making your final decision.

FAQs

Where can I trade for free in South Africa?

The only way you can trade for free in South Africa is through demo accounts, where you earn no profits. However, when it comes to buying and selling stocks on a live trading account, you can do so for free if you choose a broker offering commission-free stock trading. Note that with such brokers, you will only incur the cost of spreads.

How do I trade online in South Africa?

Trading online in South Africa is easy if you are above the legal age of 18 years. You also need to find a trusted broker that is regulated by tier-one financial authorities, such as the Financial Conduct Authority (FCA) and the Financial Sector Conduct Authority (FSCA) in South Africa. Once you have confirmed this, create an account through their website, make the necessary deposits and try your luck!

Can I use Robinhood in South Africa?

No. Unfortunately, Robinhood is only available to United States investors. Worry not because there are better alternative stocks and share brokers to choose from. Most of which are recommended in our mini-reviews above.

How to choose the best stock broker in South Africa?

Although there are other ways to find the best stock broker in South Africa, the easiest and most time-efficient way is to choose from our recommended brokers above. This is because our researchers are professionals in the trading industry. Therefore, with their findings, together with honest user reviews, you can rest assured that the stock brokers you find here are by far the best in South Africa.

Can I start trading with $100 in South Africa?

Yes. $100 is a substantial amount to start trading in South Africa. Note that the brokers we recommend above have different minimum deposit requirements, most of which are $100. This makes it easier for you to trade with limited funds.

Can I make a living day trading in South Africa?

Yes. It is possible to make a living day trading. However, to get to this point, you will need to practice and be patient in order to trade like a professional. Once you accept losses and take it as a learning process, you have a chance of making a living day trading in South Africa.

Conclusion

We believe that you now have a firm grasp of the best stock trading brokers and platforms in South Africa. We left no detail out when reviewing these stock brokers to help you make informed decisions. Even though you may have the best stock brokers in your corner, it is essential that you learn the necessary trading skills to increase your chances of making a profit.

Note that when reviewing the best stock trading platforms in South Africa, we consider various factors including:

- The security on both their web and mobile trading platforms.

- Market assets must access comprehensive coverage, including commodities, precious metals, stock indices, and more.

- The features of the trading platforms should be user-friendly and reliable. The technical and charting tools should also be simple, making it flexible for both beginners and experts.

- We also look into the brokers’ trading costs. That is why in our reviews above, we not only recommend how flexible a broker is, but we also state if their charges are high or low. This puts you in a better position to make informed decisions.

All the stock brokers we recommend in our reviews are licensed and regulated by top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investment Commission (ASIC) in Australia. So, instead of worrying about your investment capital, concentrate on ways to improve your trading experience.

We usually advise our readers to figure out their trading needs first, before choosing a stock broker. Identify your trading capital and the financial instruments you wish to try. That way, you can easily select a broker that suits your trading requirements.

Whether you are a novice or experienced trader, it’s always suitable to take advantage of these stock brokers’ demo accounts. This way, you can experience how a broker’s trading platform works, before making a final decision.

Note: Your feedback is of utmost importance to us, so feel free to leave any questions or comments below. Whether they concern stock trading, investment, or anything that crosses your mind during your tour on our website, we promise to respond as soon as possible.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years.Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS