We understand the frustration. That is why we step in to help in making your research as simple as it could. We have done most of the research process for you and listed the best forex brokers and platforms in Ireland. So, all you need to do is confirm the one that matches your trading requirements and start trading!

Our Top 5 Forex Brokers & Platforms for Ireland:

- The Best Forex Broker in Ireland: AvaTrade

- The Best Forex Trading Platform in Ireland: Forex.com

- The Best Broker For Forex Investors in Ireland: CMC Markets

- The Most Trusted Online Forex Broker in Ireland: IG Markets

- One of the Best CFD Brokers With The Lowest Spreads in Ireland: Plus500

In This Guide

Which is The Best Forex Broker in Ireland?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

There could be no better broker for forex trading in Ireland than AvaTrade. First, it is based in Dublin, Ireland, which means it primarily bases its services on the local residents. Secondly, and most importantly, it is regulated by its local financial authority, the Central bank of Ireland, which is also a subsidiary member of the Markets in Financial Instruments Directive(MiFID).

Another reason to consider AvaTrade as the best forex broker is that it offers its clients one of the most intuitive trading platforms for forex trading. You can trade forex across various local and foreign markets using more than 50 currency pairs.

Trading forex on AvaTrade will only require you to make a minimum deposit of $100. You do not need to worry about incurring the transaction costs since it’s free. Trading charges are also commission-free, but you will have to pay spreads, which we consider to be among the most competitive in the business.

On the negative side, this forex broker charges a relatively high inactivity fee that kicks in after barely three months of not opening a position. Therefore, we primarily recommend it to active traders.

Which is The Best Forex Trading Platform in Ireland?

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

Forex.com is worth test driving, whether you are looking for a forex trading platform that delivers performance, speed, or flexibility. It is a very easy-to-use platform with high customisability features and many order types. It is a host of everything you will need to get started with forex trading.

Being the world’s largest MetaTrader forex broker, you will have access to diverse trading markets. This includes over 4,500 markets using +90 currency pairs. The platform also has different account types that are perfectly tailored for each trader’s needs.

Forex.com also excels in this category because of its competitive trading commissions. It also has a low minimum deposit requirement of $100 and allows you to make deposits and withdrawals for free. Additionally, the broker’s inactivity fee takes 12 months to kick in, which is relatively reasonable compared to other forex brokers in Ireland.

Finally, Forex.com supports you with plenty of research resources. Educational materials are also at your disposal, which includes a demo account to test drive it before making the big decision.

Which is The Best Broker For Forex Investors in Ireland?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC Markets is a pioneer broker with a long track record. That is why it has become the first option for the majority of Irish forex investors. What interests us the most about this broker is that it offers more than 330 currency pairs, which is a huge advantage for investors.

The spreads on CMC Markets are low, starting from only 0.7 points across the major currency pairs. This means that if you are an investor on a low budget, then CMC Markets will serve you right. Opening a trading account is also easy and free, and on top of it, you do not have to make a specific minimum deposit to start trading.

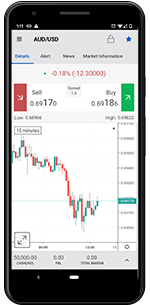

CMC Markets offers different trading platforms, all of which are fully functional on mobile devices. Whether you prefer using the standard or advanced platform, you get to keep track of your investments regardless of where you may be. This forex broker is also known to have one of the industry-leading charting packages, so take advantage and start investing for that extra cash.

Which is The Most Trusted Online Forex Broker in Ireland?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

There are so many reasons that make IG Markets the most trusted by Irish traders. Not only does it have a long track record in the industry, but it has earned its way up to become the world’s biggest CFD provider. It is also regulated by multiple financial world-class authorities, hence solidifying its credibility even further.

This forex broker opens the gates to thousands of tradable instruments, totaling over 17,000. You can access these markets using various trading platforms it offers, including ProRealTime, L-2 Dealer, and the MetaTrader 4, depending on your experience level.

We understand that expert traders need a platform where they can expand their capabilities. IG Markets gives you the option of managing your own trading activities through the Direct Market Access feature or execute your trades automatically using created algorithms.

Note that IG Markets trading charges are on the higher side. Low-budget traders might be hesitant about trading forex using it, but we assure you that with the most advanced trading tools this broker offers, it is worth the risk.

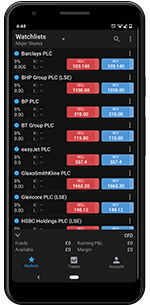

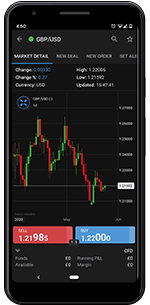

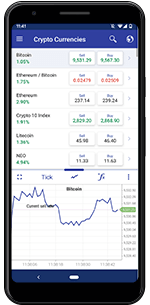

One of the Best CFD Brokers With The Lowest Spreads in Ireland

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

There are more than 60 currency pairs to trade as CFD with on Plus500 across thousands of markets. Many forex traders use the major currency pairs that usually carry low volatility, thereby minimising the security’s risk. They are also a preferred choice because Plus500 offers them at the lowest spreads.

If you are an active trader, Plus500 is for you. With the low spreads, you can easily open many positions daily and expand your opportunities. This means that it doesn’t charge forex trading commissions.

Opening a trading account is straightforward, and traders will get it done in minutes. The least amount to deposit is $100 for you to kickstart your activities, and you will not be charged the broker’s transaction fees.

Plus500 has inactivity, overnight, and currency (in some cases) fees. It also does not have extensive research and learning tools, and its platform is only the proprietary one, making it rate among the least choice for expert traders.

How to Choose the Best Forex Broker in Ireland?

The one thing that many forex traders find challenging to understand is that a good forex broker can make you have an increased chance of making profits. This is because you are guaranteed all your trading requirements, and all you have to do is focus on the strategies.

The following are what you need to look for in Ireland forex brokers before settling for your favourite one. Use them to make informed decisions and begin your trading venture on a perfect note.

- Licenses/Regulations

Although not all brokers in Ireland must be regulated by the Central Bank of Ireland, they must be MiFID approved. This lets you trade under the protection of the European Union and also secures your investment capital.

- Market assets

Forex brokers like the ones we recommend must host many tradable instruments and allow you access to both local and foreign trading markets. This gives you an option to extend your opportunities in the foreign markets if you are a local trader. You can also try trading on other assets in case you want to invest in something new.

- Platforms

The best forex broker should have a trading platform that makes your trading experience worthwhile. Your trades should be executed seamlessly and fast. Also, its app should be supported on all mobile devices and backed up with the necessary trading tools, including research and learning tools such as demo accounts.

- Trading charges

Forex trading can be attractive in that you find yourself spending more than you had expected. Therefore, have a budget before choosing a broker that you can afford. Start with a small capital and increase gradually as you get to know more about how it works.

- Payment methods

Many traders go through the hassle of currency exchanges when making a deposit because they did not confirm the payment methods available on a broker before getting started on its platform. This process can cost you more than you had planned for and consume more time which you could have used to trade. Therefore, it’s also essential to confirm payment methods and see if you are comfortable transacting using them.

- Customer support

Reliable customer support gets your trading issues sorted as soon as they arise. For example, when trading forex CFDs, time is usually of the essence. In case you experience any trading issues, the response rate of customer service will give you the best or worst experience.

Forex Trading in Ireland: Guide for Beginners

Ireland is one of the most stable economies in Europe, let alone globally. Therefore, it is a country where most brokerage firms see the potential of making money. Note that the Central Bank of Ireland is the leading financial regulator that oversees all the brokers’ activities. But, you will find that not all of these brokers hold permits from the local financial authority.

Ireland is a member of the European Union, and with this membership comes a lot of benefits. One of them is that the EU protects Irish traders under the regulations of MiFID II. This means that for a broker to accept Irish clients, it doesn’t have to be approved by the Central Bank of Ireland as long as it holds a permit from the MiFID II. That is why you will find some brokerage firms with licenses from the CySEC and the FCA.

As a novice forex trader, we advise you to get into this venture with a plan. Find ways in which you can manage the risks involved and have a better understanding of the markets you are about to trade. Once you figure this out and are backed up with a suitable forex broker for your needs, then you are set to try your luck in the forex market.

FAQs

Is forex trading tax-free in Ireland?

No. Unless you are spread betting, all the profits you make from forex trading are subjected to capital gains tax at the end of the tax year.

Is Robinhood available in Ireland?

No. Unfortunately, Robinhood is only available for US residents and does not accept Irish clients. The good news is that there are still many best forex brokers you can choose, like the ones we recommend above.

Is forex trading legal in Ireland?

Absolutely. You are required to use a licensed and regulated broker by the top-tier regulatory bodies that have been approved by MiFID II, including the Central Bank of Ireland, which is the primary regulatory body in the country.

Do forex brokers report to the IRS?

No. Profits from trading forex, especially in the foreign markets, are not reported to the IRS because they are considered simple interests.

How difficult is Forex?

We can’t say forex trading is difficult because many traders are succeeding with it. However, it is a challenging venture if you do not apply the right strategies. Also, you need the best broker that complements your essential trading requirements, such as the ones on our mini-reviews above.

How do forex traders pay tax?

Profits from forex spread betting are not subjected to any form of taxation in Ireland. However, any personal profits you earn trading forex will be required to be filed as capital gains tax every tax year.

Conclusion

Ireland is a stable economy, and finding the best forex brokers and platforms is a challenge to many Irish traders. If you follow this guide, we assure you that your chances of becoming a successful trader are on the higher side. Also, have a broker’s trading app installed on your mobile device, so you do not need to worry about your trading activities even on the move.

Note: Customers’ feedback is what encourages us to make this place better. Therefore, feel free to leave your message below, whether questions or comments, and we will respond promptly.

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact usdirectly to learn more about the team.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact usdirectly to learn more about the team.

COMMENTS