Forex trading is thriving in Singapore and the number of available top forex brokers has never been bigger.

On the following page, we have concluded our detailed review of the forex market in this country and listed the very best forex brokers in Singapore.

Our Top Forex Brokers & Platform Picks for Singapore:

- Best Forex Trading Platform: Forex.com

- Best for Competitive Spreads: CMC Markets

- Best for Variety of Forex Pairs and Good Customer Service: Oanda

- One of the Best CFD Brokers for Advanced: Plus500

- Best MAS Regulated ECN Broker: Interactive Brokers

- Largest Foreign Exchange Retail Broker: IG Markets

- Highest Leverage CFD Brokers: CMC Markets

- Best Forex Broker with No Minimum Deposit Amount: Oanda

In This Guide

Best Forex Trading Platform in Singapore

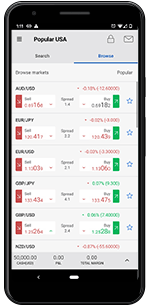

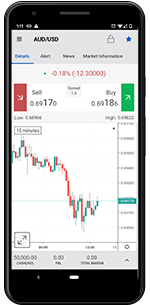

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

If you want to keep things simple and just opt for the best forex trading platform in Singapore, we suggest you open an account with Forex.com. This well-renowned, European forex broker represents the epitome of online forex brokerage.

When trading forex with Forex.com, you can expect access to leading platforms and analytic tools, great customer service, and an exciting selection of assets.

As a customer, you can pick to trade forex using MetaTrader 4 or Forex.com’s propetriary Advanced Trading platform. Both platforms are available across all the most popular devices, including Mac, PC, iOS (iPhone & iPad) and Android.

Best Forex Broker for Competitive Spreads in Singapore

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

CMC is a fantastic online broker that has been serving the Singaporian market for several years. In addition to a large number of forex pairs and tens of thousands of stocks and other assets, CMC Markets is one of the most varied brokers on the market.

Better yet, CMC is currently the best broker for competitive spreads, a feature which they’ve combined with low margin requirements, no minimum deposit and high leverage.

With that said, CMC doesn’t have the best forex platform in Singapore; they “only” offer a great platform with beneficial pricing and low trading fees.

Best for Variety of Forex Pairs and Customer Service

Oanda is one of the world’s most elite online brokers based in New York and with a global reach that few brokers can compete against.

✔ Their unparalleled global reach

✔ 5 different platforms

✔ High fees and commission

✔ A limited selection of assets in some jurisdictions

✔ Their unparalleled global reach

✔ 5 different platforms

✗ High fees and commission

✗ A limited selection of assets in some jurisdictions

Fees: Commission, fees, and spread depending on the assets/securities

Demo Account: Yes

Min Deposit: 0

Assets: Thousands

Licenses: (CFTC), (FCA) & (IIROC)

Oanda is not only a top broker in Singapore, but one of the most well-established online brokers globally. Based in the United States, with a presence in Europe and Asia, Oanda is one of the most well-regulated brokers available today.

This broker currently offers more than 70 different currency pairs, including all the majors and minors. That means you can trade SGD with a range of currencies, such as USD, EUR, and GBP.

While reviewing brokers for this site, we always contact the said broker using all their contact channels, to ensure that they provide satisfying customer service. In the case of Oanda, we always received detailed and timely answers and so we are impressed with their level of service.

One of the Best CFD Brokers for Advanced in Singapore

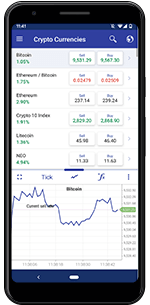

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Forex trading is never simple, so even advanced traders need to find reliable and powerful trading platforms with comfortable trading conditions. You need to remember that there is a risk involved when trading, and losses could occur if the traders are not familiar with the broker or the instrument they have chosen to trade with.

Right now, one of the best trustworthy trading platforms for experienced traders in Singapore is Plus500. Their trading platform was designed in-house and has been praised for its ease-of-use and clean design, which makes your trading more comfortable. Moreover, the broker has a great variety of CFD instruments and powerful trading tools for comfortable trading. Plus500 is regulated by the Financial Conduct Authority(FCA).

Besides, Plus500 is one of the world’s top CFD brokers and a really trusted trading platform for seasoned professionals who want to trade forex in Singapore.

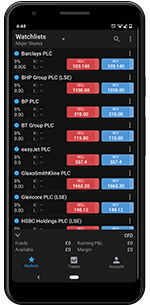

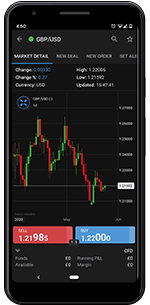

Best MAS-Regulated ECN Broker in Singapore

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✔ Long processing time for withdrawls

✔ High commission for small positions

✔ One of the biggest online brokers in North America

✔ Top-shelf trading software for all customers

✗ Long processing time for withdrawls

✗ High commission for small positions

Fees: Rather high fees

Demo account: Yes

Min deposit: $100

Assets: Huge selection

License: SEC, IIROC, FCA, ASIC

ECN forex trading is the fastest and most accurate way to trade forex in Singapore, due to the speedy execution that’s required of ECN brokers.

As expected, we’ve tested and reviewed several of the leading ECN brokers in Singapore and are now convinced that Interactive Brokers is the best MAS-regulated broker.

Interactive Brokers is an American-based, multi-asset broker that offers their incredible trading platforms and features all around the world. Also, besides being regulated in Singapore, IBKR has attained several impressive licenses from some of the world’s strictest regulatory bodies.

Largest Foreign Exchange Retail Broker in Singapore

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

There is no doubt that IG Markets is the largest foreign exchange retail broker that’s currently operating in Singapore.

This massive broker is based in the UK and is considered to be one of the greatest and biggest online brokers to have ever existed. IG Markets is well-established with 15,000+ assets on offer (including forex, CFD on forex, and spread on forex) and more than 200,000 active customers.

If you’d prefer trading with a serious broker that always puts their customers first and tirelessly works to offer the best trading opportunities out there, then IG Markets is the broker for you.

Highest Leverage CFD Brokers in Singapore

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

In Singapore, CMC Markets are known for two things: no minimum deposit, as well as high leverage with low margin requirements.

With that being said, most brokers in Singapore offer similar leverage levels according to all the relevant regulation and trading laws. Therefore, you can expect to be offered close to the same leverage with all brokers.

Now, if you want to be sure that you’re provided with the greatest forex leverage in Singapore, we suggest you check out CMC Markets.

Best Forex Broker with No Minimum Deposit Amount in Singapore

Oanda is one of the world’s most elite online brokers based in New York and with a global reach that few brokers can compete against.

✔ Their unparalleled global reach

✔ 5 different platforms

✔ High fees and commission

✔ A limited selection of assets in some jurisdictions

✔ Their unparalleled global reach

✔ 5 different platforms

✗ High fees and commission

✗ A limited selection of assets in some jurisdictions

Fees: Commission, fees, and spread depending on the assets/securities

Demo Account: Yes

Min Deposit: 0

Assets: Thousands

Licenses: (CFTC), (FCA) & (IIROC)

Oanda is one of few online forex brokers that have no minimum deposit requirements needed to activate a new trading account. This is a great feature since it gives you the chance to open an account and check the broker out, before you make a deposit and start trading.

Keep in mind that you will have to deposit money to start trading with Oanda. Alternatively, you can open a Oanda practice account that you can use to trade on Oanda’s platform using virtual money

How to Choose a Forex Broker as a Singapore Trader

There are a few things to consider when choosing a forex broker in Singapore to ensure that you get the best broker for your needs.

As mentioned several times before in this guide, safety should always be your number one concern.

In addition to that, there are some factors that will help determine your decision, such as their commission and spreads, the assets they offer, different account types, and so forth.

Requirements to be a Forex Broker in Singapore

To offer forex trading services in Singapore, a broker has to be licensed by the Monetary Authority of Singapore (MAS).

MAS is considered to be one of the strictest financial regulatory bodies in the world and their licenses are well-respected. Furthermore, due to their reputation of being strict, MAS have inflexible requirements regarding customer protection, funds protection, transparency, and much more.

Our point is that it isn’t easy to be approved as a forex broker in Singapore and most who try to attain a license are denied.

Commissions and Spreads

When picking a broker, you also want to study the broker’s commission, spreads, and fees to make sure that they’re fair. Today, forex brokers do not tend to charge commission on forex trades. However, when trading stocks, commodities, and such, you can expect to be charged certain fees.

Instead, forex brokers make profit from charging spread on every forex trade, so you want to find a broker with low and fair spread.

Brokers also charge non-trading fees related to inactivity, transactions, etc. and these fees tend to differ in size from broker to broker.

Account Types

Many of the top forex brokers in Singapore offer different account types, depending on how much you’re willing to trade for, the platforms you’re interested in using, ECN accounts, Direct Market Accounts (DMA), etc.

Make sure you find a broker that offers an account that suits your style, but also preferably an account tier solution that allows you to “climb the ladder” and get benefits the more you spend.

Customer Service

Always test the customer service before signing up with a new broker. Chances are high that you will need help from the broker at some point and so you want to be sure that the support is there.

Because of this, we test the customer service of every broker that we review and detail our experience with them in our reviews.

Additional Services

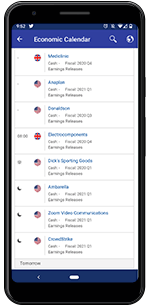

The above are the basic factors to look at when finding a broker. The last step is to look for any specific additional services that a broker might offer. For example, do they offer copy trading or forex robots? How is their educational material?

While these factors aren’t the most important, they will help you make a better and more suitable decision.

What is the Monetary Authority of Singapore (MAS)?

The Monetary Authority of Singapore (MAS) is the central bank of Singapore and effectively the financial regulatory body of the small Asian nation.

MAS is tasked with regulating, overseeing, and safe-keeping the financial sector, including issuing broker licenses.

How to Verify MAS Authorisation

The best way to do so is to visit MAS’s website and search their directory. Every broker with a license, as well as every “black-listed” broker, can easily be found on their site.

Is it wise to consider MAS-regulated brokers?

Yes, you should only ever trade with regulated brokers in Singapore. This is for your own safety.

Singapore Forex Trading FAQs

Why do people trade forex?

The foreign exchange market is the biggest financial market in the world and there are millions of people who trade on it daily.

Forex trading is also potentially highly profitable for those who master the trade and it’s one of the most exciting and fast-paced forms of trading available to us today.

Thanks to its large size and the constant stream of currencies across the globe, the forex market provides a higher liquidity than most other markets.

How can I check if a Singapore forex broker is reliable?

There is only one way to do this, which is by contacting the Monetary Authority of Singapore (MAS). They are responsible for regulating the forex market in Singapore, as well as issuing broker licenses.

This means that all reliable forex brokers in Singapore have a license from MAS.

You can also double-check a broker’s reputation by checking our broker reviews and trading guides. We only recommend safe, regulated and reliable brokers.

Is forex legal in Singapore?

Yes, as long as you’re 18 years old and trade forex using a regulated broker, forex is legal in Singapore.

Is income from forex taxable in Singapore?

As long as you’re trading forex as a hobby (ie. not as your main source of income), forex trading is completely tax-free in Singapore. However, as a professional day trader, you have to pay regular income tax on all your profits.

Contact your local tax office for more information and recommendations.

Note: Don’t hesitate to leave a comment below in case you have any questions regarding trading apps, safety, day trading, investments, financial systems, or anything else that might come to mind while spending time on our website. We promise to answer you as soon as possible.

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact usdirectly to learn more about the team.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact usdirectly to learn more about the team.

COMMENTS