In This Guide

Which Are The Best Trading Apps in the UK?

- One of the Best Trading Apps: Plus500

- Best Stock Trading App: IG Markets

- Best Long-term Investment App: Revolut

- Best Free Trading App: AvaTrade

- Best Trading App for News & Education: Financial Times

To further help you find the best trading app for your specific needs, we’ve divided this guide into different categories where we’ve listed the best apps based on different criteria.

For example, the best stock trading app, the best long-term investment app, and our favorite business news app, to mention a few.

Below, you can find detailed descriptions about the said trading apps, including all the information you need before signing up such as fees, payment options, and pros.

In the name of transparency, we’ve also included cons and things that could be improved.

Which is one of the Best Trading Apps in the UK?

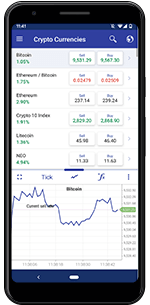

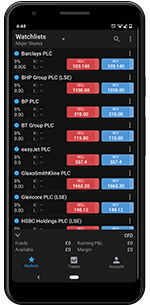

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Plus500 is one of the best multi-asset CFD trading app in the UK because they offer a great selection of different asset classes and instruments. Not to mention one of the top mobile trading software that we’ve ever come across.

Not only has Plus500’s app won several prestigious awards over the years, but it is currently one of the highest-ranked trading apps in both Google Play and Apple App Store.

Which Is The Best Stock Trading App in the UK?

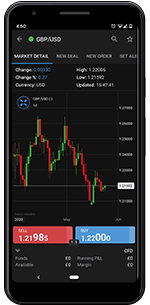

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

IG Markets is one of the oldest online brokers in the UK. And thanks to a combination of great software and more than 10,000 shares on offer, IG Markets offers the best stock trading app in the UK.

Better yet, the app allows you to trade stocks as they are (Direct Market Access), as Contract for Differences (CFDs), or try your luck with spread betting – which is tax-free in the UK. You are not charged commission when trading stocks as they are.

Which Is The Best Long-term Investment App in the UK?

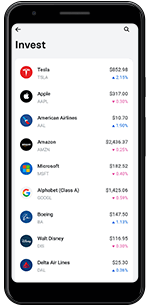

Revolut is effectively changing the way we handle money, transactions, and investments on a global scale.

Their services are only offered through a mobile app that allows you to open bank accounts as well as invest in stocks, cryptocurrencies & commodities.

✔ Commission-free stock trading

✔ Fractional stocks for as low as £1

✔ Virtual bank account

✔ Not great for short-term trading

✔ No investment demo account

✔ Problems with the automated account-suspension

✔ Commission-free stock trading

✔ Fractional stocks for as low as £1

✔ Virtual bank account

✗ Not great for short-term trading

✗ No investment demo account

✗ Problems with the automated account-suspension

Fees: 0% commission stock trading

Demo Account: No

Assets: 850 stocks.

License: European Central Bank (UK banking license is pending).

In case you’re looking for an app for long-term stock investments, there is one that stands out above all competition; namely Revolut.

Revolut is a British fintech company offering bank accounts, virtual bank cards as well as Visa & Mastercards. Then there is a state of the art mobile investment platform where you can invest in stocks, cryptocurrencies, and commodities.

The company was founded in 2015 and has already taken the world by storm. After the latest round of investments in February 2020, Revolut became the most valuable fintech company in the UK.

Stock investments with Revolut are commission-free and extremely easy to conduct. You also have the option of buying fractions of company shares for as little as £1 per trade.

Which Is The Best Free Trading App in the UK?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

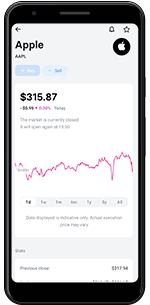

AvaTrade’s app, AvatradeGo is the best free trading app in the UK and the rest of Europe now. The app was developed in-house and features a plethora of excellent tools that help improve your ability to trade, even when you’re on the go.

This trading app is available on iOS (iPhones & iPads) as well as Android, and it’s free to download and register an account.

Opening a demo account with AvatradeGo does not cost anything. Just keep in mind that AvaTrade will charge trading fees such as spread when you trade using real money.

Which Is The Best Trading App For News & Education in the UK?

Financial Times is a daily financial & business newspaper with some of the most reliable and up-to-date trading information on the market.

I'ts free to use FT and the service gives you incredible trading news directly to the device of your choice.

✔ Daily business news and updates

✔ News notifications on your smartphone

✔ Costly subscription for the printed edition

✔ Lots of negative reviews on their customer support

✔ Daily business news and updates

✔ News notifications on your smartphone

✗ Costly subscription for the printed edition

✗ Lots of negative reviews on their customer support

Price: £37,50/month (digital), £60/month (print)

Based in: London, UK

Political alignment: Liberal

Founded: 1888

Since 1888, Financial Times has provided the UK with the latest financial news and breaking economic news. Today, Financial Times is a global phenomenon with one of the best trading apps for news and education.

With the app, you can enjoy international business news, market data, company information, browse different securities, and set up news alerts. All you have to do is download it from one of the app stores and you’ll have direct access to priceless market statistics and news in the palm of your hand.

Everything you need to stay up to date with the latest investment news can be found in this app.

Your Trading App Guide

How To Choose The Best Trading App?

Choosing the best trading app is a personal decision that’s completely based on each trader’s unique preferences.

That being said, there are a few things to keep in mind when finding the best trading app in 2022.

First and foremost, you should never use a trading app or broker that is not licensed and regulated.

In the United Kingdom, it’s the Financial Conduct Authority (FCA) that oversees the market, and in the rest of Europe, the responsibility falls on the Cyprus Securities and Exchange Commission (CySEC). Every region in the world, has their own financial regulatory body, in Australia it’s ASIC and in South Africa it’s FSCA.

Naturally, you also have to ensure that the app supports the securities you want to trade, that you think the fees are fair for the service offered, and that you feel comfortable with the app in question.

We recommend that you open a demo account with a broker before signing up and making your first deposit. That way, you get a chance to try it out before making your final decision.

How Do We Pick the Best Trading Apps?

In order to only recommend the best of the best, our team follows a strict protocol when reviewing and testing brokers.

During a process that often takes several days, we test everything a broker and its app has to offer.

We always start by ensuring that the app is operating legally with all the necessary licenses. Then we take a close look at the selection of assets offered and what it costs to trade using the app.

Once we’re happy with what we find, we put the app through rigorous tests where we trade, invest, and use the app as much as we can.

Based on these tests, we determine which broker has the best trading app for certain tasks such as stock trading, or free trading, etc.

How Do I Start Trading Stocks In The UK?

Learning how to trade stocks is not easy by any means. That being said, it’s not impossible if you put some effort into it.

The most important thing to keep in mind is that you’ll need a lot of patience.

Naturally, you also need access to an online stock trading platform, either on your computer or smartphone.

It will also get easier the more you practice and with the use of some tested stock trading strategies, you’ll even be able to start making some profit.

Let’s also take this opportunity to differentiate between stock trading and stock investments. Generally speaking, long-term stock investments are slightly easier to do well with as a beginner.

Do Day Traders Pay Tax In The UK?

That depends on how and what you trade and there is no fixed tax rate. For example, when spread betting in the UK, you don’t have to pay taxes.

However, when trading CFDs and regular stocks, you are obliged to pay taxes on your profits.

Furthermore, you pay taxes based on your other income and employment. Because of this, it’s advisable to contact a tax accountant before you start trading. That way, you can avoid nasty surprises down the road.

Are Trading Apps Safe?

Yes, trading apps are safe as long as you use a respectable and licensed trading app.

The same goes for any online trading as long as the broker in question is regulated.

With that said, you always run the risk of losing the money you invest. Thus, improving your skillset and applying tested strategies, will make trading even safer.

What Is Online Stock Trading?

Online stock trading refers to trading stocks online using a broker or stock trading app.

A stock, also called a share, is a security that represents a unit of a company that the shareholder owns.

Like any security, stock prices are affected by the companies performance as well as global and local economic developments.

The aim when trading stocks is to predict when a stock will increase or decrease in price and either buy or short-trade (sell) the stock.

In most cases, stock trading refers to when you’re buying and selling stocks with short-term goals that might span a few minutes, hours, or days, which separates it from long-term stock investing where you hold shares for months and often years.

FAQs

What app can I buy stocks with?

Which stock trading site is best for beginners?

Is there an app to practice stock trading?

Do investing apps really work?

Are investment apps worth it?

What is the best stock investing app?

Where can I trade for free?

How can I invest for free?

How can I buy stocks for free?

What is a social trading platform?

Is copy trading legal?

How do copy traders make money?

How do I start copy trading?

Which is the best app for stock market news?

How do I follow financial news?

How are day traders taxed?

Do I pay tax on share dealing?

Is online trading safe?

What to think about before you invest?

Is day trading illegal in the UK?

Can I deal in shares through a mobile app?

What apps allow day trading?

How much money do you need to day trade in the UK?

Which banks are best for share trading?

What do I need to start day trading?

How can I buy shares in the UK?

What is a share?

How to buy shares?

How to hold shares?

How to sell shares?

Can I buy shares in any company?

What is an ETF (Exchange-Traded Fund)?

What is an Investment Trust?

What are Funds (Unit Trusts and OEICs)?

A fund is a pool of money that’s used for investments that are shared by the investors that placed money in the pool.

There are different types of funds such as mutual funds and more specific funds. For example, a unit trust is a fund where profits are shared between investors instead of being reinvested into the fund. An OEIC (Open Ended Investment Company) is a type of fund that’s similar to a mutual fund and that’s typically only sold in the UK.

What is a stop-loss order?

Conclusion

There is a good selection of top trading apps in the UK 2022 and finding one that suits you should not be a major issue. Using this trading app guide makes the process easier since you can find the best trading app for your needs directly.

Note: Don’t hesitate to leave a comment below in case you have any questions regarding trading apps, safety, day trading, investments, financial systems, or anything else that might come to mind while spending time on our website. We promise to answer you as soon as possible.

Trading Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America:

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America:

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa:

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East:

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia:

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.Our Author:

COMMENTS

We have opened up the comment section in this article since we believe its important that our visitors can voice their opinions on the trading apps recommended for UK Traders.

– Keep the tone civilized, any foul language will not be accepted.

– We are looking for comments related to the investment apps listed in this article, and for trading apps in general. Only regulated apps will be accepted.

– User reviews are much appreciated.

– If you have any customer support issue we recommend that you contact each brokers customer support team.

// BM

I am primarily looking to buy shares, and I am based in the United Kingdom. I want access to a lot of assets and I want to do all my trading on my mobile phone.. so I did a few searches and I ended up here. Based on what you written here, I think Plus500 or Markets would be a good option?

I use an Applie, iOS, so needs to be compatible with that.

Hi Steven,

Markets.com and Plus500 would indeed be excellent choices of trading apps if a large amount of tradable assets is what you are looking for, in fact, both these brokers are offering thousands of instruments.

Another good pick would be eToro, as they are also offering a quite large amount of assets.

All the apps listed in the article are compatible with iOS.

// BM

After having tried several demo accounts with the share brokers you list here I have concluded that my favorite option is Avatrade, gave me least hassle to register and they offer a really good app for trading.

My second option would be markets.com due to simplicity. anyone can use their app

Hi Niklas,

We are happy to see that you have tried several of the listed investment apps. And we are super happy that you shared your thoughts about it. Thanks a lot.

BR,

BM

Is this the best way to buy shares?

Hi Shares,

This is an article about the best trading apps UK, with that, said, this is just one of several ways to buy shares (stocks), crypto or trade forex. CFD trading is great but does not fit everyone. When it comes to the apps themselves they far outperform most traditional stock brokers.

// BM

Are these apps free?

All of these apps have a free demo account. You can use that demo account to test the app or practice different trading strategies.

// BM

Been trading a while on my android now, previously I had a laptop. All in all, you are quite limited with a trading app. I guess it’s OK for casual traders.

Which is the best app for share trading? I mean buying stocks, not trading CFDs only.

Hi Nils,

Based on what you are saying it’s looking like you are looking for an app where you can buy shares AND trade them as CFDs? If this is the case then IG offers a great app for you. They sell shares and lets you trade them as CFDs. They are also very respected and safe.

// BM