We’ve tested all of the top apps and outlined the results of those tests in this guide to the best UK investment apps in 2022.

In This Guide

Our List of the Trading Apps in the UK:

- Best Mobile Investment Platform in the UK: IG Markets

- Best Investment Account in the UK: DeGiro

- Best Micro Investment App in the UK: CMC Markets

- Low-Commission Investment App for CFD trading: Plus500

- Commission-Free CFD Provider With a Mobile App: AvaTrade

- Trusted UK Share Dealing Platform With Competitive Fees: DeGiro

- Best App for Automated Investing: AvaTrade

Which is the Best Mobile Investment Platform in the UK?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

IG Markets is one of the main online brokers in the UK, with experience spanning more than 40 years. The investment platform offered by IG belongs to the top-tier of trading tools, which is the reason why IG Markets has become a household name among UK investors and traders.

Today, IG Markets provides access to several platforms that serve different purposes. Some platforms are designed for spread betting, CFDs, and forex trading, while they also provide a great investment platform.

IG Market’s selection of assets is incredible, with more than 15,000 instruments listed. However, this is both a blessing and a curse, since it’s rather overwhelming to be presented with so many options.

Which is the Best Investment Account in the UK?

This Dutch-based financial institution has managed to develop a serious stock investment broker that feels and operates like a regular online broker.

To us, it’s a perfect combination.

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✔ No demo account

✔ Rather high commission

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✗ No demo account

✗ Rather high commission

Fees: Charges commission and other trading fees

Demo Account: No

Min. Deposit: N/A

Assets: Thousands

License: FCA and AFM (Netherlands)

DeGiro is a Dutch online investment broker with one of the most solid products on the UK market. With a DeGiro investment account, you get access to your entire portfolio, all your favourite tools, and DeGiro’s full list of tools from any device.

With the option of investing in stocks and other instruments from your phone with an account that helps optimise your ability, it should come as no surprise why DeGIro currently has the best investment account in the UK.

With that said, DeGiro is not commission-free and the broker is best suited for investments, ie. it can’t be used to combine investments with your trading strategy.

Which is the Best Micro Investment App in the UK?

CMC Markets is a global trading service based in the UK but with customers and offices all around the globe.

A combination of great trading tools, tons of assets, and long experience in the industry make CMC Markets an excellent choice for most traders.

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✔ Complicated registration

✔ High spread on stocks

✔ Fees on many transactions

✔ Huge selection of assets

✔ Well-established broker

✔ Top-notch trading platform

✗ Complicated registration

✗ High spread on stocks

✗ Fees on many transactions

Fees: 0 commission on FX and CFDs

Demo Account: Yes

Min Deposit: Zero

Assets: 10,000+

License: CySEC, FCA, ASIC

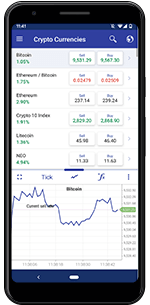

Micro investments are small investments in different instruments, typically using derivatives such as CFDs and spread betting. If that’s the type of investments you’re looking for, we recommend CMC Markets as the best micro-investment app in the UK right now.

CMC Markets distinguishes itself as a top online broker with a huge collection of instruments suitable for both beginners and advanced experts. Naturally, investors also get access to both desktop and mobile trading software, including an award-winning trading app.

For years, CMC Markets has been an established broker on the UK market, and while the broker qualifies as the best micro-investment app in the UK, they do charge rather high fees. We’ve also read reviews that claim CMC Markets’ platforms are a bit too complicated for inexperienced users.

Which CFD Investment App has Low Commission in the UK?

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Plus500 is not only a low-commission investment app, but a commission-free investment app. Instead of commission, Plus500 charges spread on every position that’s opened and closed, as well as certain non-trading fees.

Moreover, Plus500 currently has the highest-rated investment app in both Google Play and the App Store, and it happens to be one of our personal favourites as well.

In case you’re looking for a great low-commission investment app in the UK, we recommend Plus500. Just note that Plus500 has a limited selection of assets on offer and, since they only offer CFDs, the app is more suitable for short-term trading, than long-term investments.

Which is a Commission-Free CFD Provider With an App in the UK?

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

AvaTrade is another completely commission-free CFD provider in the UK that’s also developed an award-winning investment app. Trading with AvaTrade is an innovative experience where you can make use of several exciting trading robots and automatic investment tools.

This broker is also different from other online investment apps in the UK since it’s regulated by the Central Bank of Ireland, instead of the FCA or CySEC. This does not affect the level of safety at which AvaTrade operates.

Unfortunately, AvaTrade has a rather limited selection of securities and their mobile platforms are more suitable for trading, than investments. Yet, AvaTrade remains one of the top commission-free CFD apps in the UK.

Which is the Best Share Dealing Platform With Competitive Fees in the UK?

This Dutch-based financial institution has managed to develop a serious stock investment broker that feels and operates like a regular online broker.

To us, it’s a perfect combination.

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✔ No demo account

✔ Rather high commission

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✗ No demo account

✗ Rather high commission

Fees: Charges commission and other trading fees

Demo Account: No

Min. Deposit: N/A

Assets: Thousands

License: FCA and AFM (Netherlands)

DeGiro is an online broker offering a share dealing platform that excels at almost everything. Investing in and selling stocks, analysing markets, and keeping an eye on your portfolio is made possible through one of the top investment apps on the European market.

This broker is not commission-free, but they do offer competitive fees and charges on almost all investments, making it a great and economically smart decision to invest with DeGiro.

Please note that DeGiro is a pure investment broker, meaning the DeGiro app isn’t suitable for short-term trading.

Best App for Automated Investing in the UK

AvaTrade represents the top tier of online brokers.

With a combination of their own software and third-party platforms, you'll gain access to some of the best trading services and features.

✔ Easily integrated trading robots

✔ Commission-free trading

✔ A limited selection of assets

✔ Rather high spread on certain assets

✔ Easily integrated trading robots

✔ Commission-free trading

✗ A limited selection of assets

✗ Rather high spread on certain assets

Fees: 0% commission but spread on each trade

Demo Account: Yes

Min Deposit: £100

Deposit Options: Debit & Credit Cards, Skrill, Neteller, Webmoney

Assets: 1,000 assets

License: Central Bank of Ireland, ASIC, FSCA, FSA

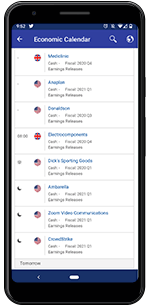

There is no doubt in our minds that AvaTrade is offering the superior app for automated investments, and the answer as to why is simple.

Compared with all other leading online brokers and investment apps, AvaTrade has put a lot more effort into developing and offering trading robots and automated investment opportunities. As an investor, you have several tools to choose from to set up your automatic investments and the tools are incredibly accurate.

As mentioned before, CFD and forex brokers, such as AvaTrade, are better suited for day trading. However, with the correct use of this broker’s automated investment tools, one can easily place profitable investments.

Your guide to Online Trading in the United Kingdom

What Is an Investment App?

The term investment app is rather self-described, ie. it’s an app that can be used to invest in instruments. Today, the best investment apps in the UK are offered by online brokers, while the more traditional stockbrokers tend to be a few steps behind.

A really good investment app has to offer all the tools you need to properly analyse your markets of interest, as well as the features needed to effectively open, close, and monitor positions.

All things considered, an investment app should be an exact copy of an investment broker platform, only designed for mobile devices.

What to Look for in an Investment App

Besides the fact that you should only use investment apps that are regulated by the Financial Conduct Authority, certain factors determine which app will suit you best.

For example, as a stock investor, your investment app needs great support for stocks, while a commodity investment app should be optimised for commodities. You also need access to tools that help you analyse markets and find value.

However, as long as the broker is safe and regulated, the most important thing is that you’re comfortable using it.

How to Find the Best UK Investment Apps

The easiest way to find the best UK investment app is to use our recommendations. We pride ourselves in being unbiased and offering the most accurate broker and app reviews online.

Every investment app and broker that we recommend has gone through countless hours of testing and auditing from our team. We do this to ensure that we only recommend the brokers and apps that are actually the best of the best.

How Safe Are Investment Apps in the UK?

UK investment apps that are regulated and licensed by the FCA are completely safe to use. An FCA license means that the said broker lives up to some of the world’s strictest investment regulations regarding funds and user safety, fairness, and honesty.

Therefore, all regulated investment apps in the UK can be considered safe.

Just keep in mind that you still run the risk of losing your invested funds, even when using a regulated app.

FAQ

Is there a monthly subscription fee to use an investing app?

No, you cannot use Robinhood in Europe, unless you live in the UK. Robinhood is a great and commission-free trading app for stocks, cryptocurrencies and commodities.

Today, the app is only available to American, British and Australian investors, but we should expect an international roll out at some point.

There are, however, other great stock trading apps that you can use instead.

Where Can I Buy European Stocks?

Most investment apps do not have monthly fees. Instead, you pay spread for each position you open and close, as well as certain non-trading fees, for example, a surcharge on transactions or overnight fees for positions that are kept open outside of regular trading hours.

That being said, most brokers and investment apps charge an inactivity fee (monthly or quarterly) for accounts that have a balance, but are inactive.

When trading stocks, should I trade CFDs or buy and sell stocks directly?

Contract for Difference (CFD) provides several great benefits, such as the ability to profit from stocks you couldn’t afford otherwise, the option to short pretty much any company, and quick investment times.

Therefore, CFDs are optimal for those looking to day trade stocks, but not necessarily for those looking to invest long-term in stocks.

Can I access my mobile trading account from a desktop?

Yes, your investment app and desktop account are the same, as long as you’re using the same broker. The idea of using an investment app is to gain access to your portfolio and analytic tools regardless of where you are.

Are UK investment apps covered by the FSCS?

Financial Services Compensation Scheme (FSCS) is a form of insurance for investors and traders in the UK. And yes, all of the regulated investment apps that we have recommended are covered by the FSCS.

Are there any free investment apps?

Yes, several apps are completely free to use, although you invest with virtual money, meaning you can’t make a profit in real money. Similarly, all the top investment apps have demo accounts, which you can use to test the platform and practice your skills, also using virtual money.

Can I trade with demo funds on my investment app?

Yes, most of the recommended brokers above offer demo accounts. These accounts can be used to trade using demo funds in the investment app you prefer.

Note: Don’t hesitate to leave a comment below in case you have any questions regarding trading apps, safety, day trading, investments, financial systems, or anything else that might come to mind while spending time on our website. We promise to answer you as soon as possible.

Our Author:

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

Adam Jarfjord is a Swedish day trader, investor, and copywriter. He works as head of content at BullMarketz.com and has been providing editorial content within the financial sector for more than 5 years. Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.

COMMENTS