In This Guide

Our list of the Best Trading Platforms & Brokers in the UK

- One of the Best Trading Platforms: Plus500

- Best Share Dealing Account: IG Markets

- Best Forex Broker: Forex.com

- Best Investment Platform: DeGiro

In the name of transparency, we’ve not only focused on all the good aspects of the brokers, but also some of the cons and issues we’ve encountered.

That way, we have painted the most honest image of what you can expect from each broker.

Further down this page, you’ll find that this trading guide covers everything from trading licenses and taxes, to tips for beginners and an extensive FAQ section.

Which is one of the Best Trading Platforms in the UK?

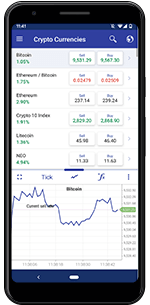

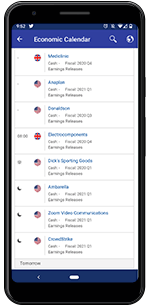

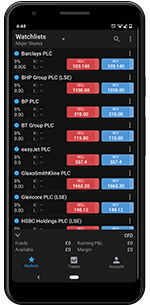

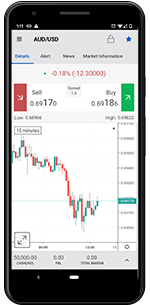

When you trade with Plus500's app, you will be using the highest-ranked trading app for both Android and iOS.

You will also gain access to some of the world's best mobile trading features and a great selection of asset classes.

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✔ Limited monthly transactions

✔ Only 2,200 CFD assets on offer

✔ Easy to use mobile software

✔ Competitive spread

✔ Top rated in both app stores

✗ Limited monthly transactions

✗ Only 2,200 CFD assets on offer

Fees: Overnight Funding, Currency Conversion Fee and Inactivity fee (read more about Plus500 fees here)

Demo Account: Yes

Min Deposit: £100

CFD Assets: 2,000+

License: FCA, CySEC, ASIC, FSCA, MAS

Plus500 is a multi-asset online CFD broker that offers CFD trading on some of the world’s most popular asset classes.

Better yet, the Plus500 trading platform for all devices, including Windows Phones, was developed in-house.

We consider Plus500 to be one of the top trading platforms, mainly because of how easy the platform is to use.

With that said, when using Plus500 compared with other top brokers, you will have access to fewer assets.

Plus500 is also one of the best trading platforms in the UK that accept PayPal as a payment method.

See our breakdown of Plus500 and its platform in the information box below.

What is the Best Share Dealing Account in the UK?

IG Markets is one of the oldest and biggest online brokers in the world.

This UK-based broker has been offering trading opportunities since the early 1970s.

Still to this day, IG Markets keeps trail blazing the industry and setting the standard for all other online brokers.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✔ High minimum deposit.

✔ Commission on spread betting and CFD stock trading.

✔ Real stock trading of the exchanges

✔ Huge selection of international stocks.

✗ High minimum deposit.

✗ Commission on spread betting and CFD stock trading.

Fees: Low spread & commission.

Demo Account: Yes

Min Deposit: £300

Deposit Options: Visa, Mastercard, PayPal, Bank Transfer

Assets: 10,000+

License: FCA, ASIC, CFTC, MAS

If you’re looking for the best UK share dealing account, then look no further. IG Markets is an established online broker based in the UK with more than 40 years of experience in the industry.

The broker currently offers access to more than 12,000 different assets, with the majority being company shares. You can choose to trade shares as CFDs, spread bet on shares (which is tax-free in the UK), or purchase the shares directly from the exchanges.

IG Market is also one of the trading platforms in the UK that offers Skrill, PayPal, Credit Cards, Bank Wire Transfers, and more payment methods.

It is worth noting, however, that IG Markets is usually better suited for advanced traders with experience, and not so much for beginners.

Which is the Best Forex Broker in the UK?

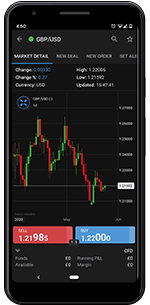

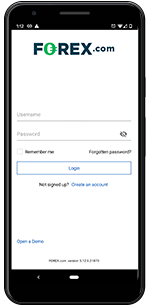

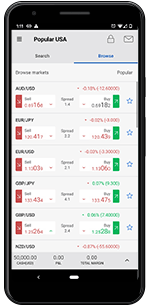

Forex.com is a top forex broker with a great reputation, 80+ currency pairs, and a selection of trading platforms suitable for any and every trader.

Even though this broker offers other assets as well – mainly CFDs – what sets them apart from their competitors is their fantastic forex trading service.

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✔ Poor selection of CFDs

✔ Long processing times for certain withdrawals

✔ Offers MT4 and an Advanced Platform

✔ Unparalleled forex service

✗ Poor selection of CFDs

✗ Long processing times for certain withdrawals

Fees: Commission-free forex trading

Demo Account: Yes

Min. Deposit: $100

Assets: 300 assets, including 80+ FX pairs.

License: FCA, CySEC, etc.

As the name entails, Forex.com is an online broker that focuses on forex trading, which is also the reason why we recommend them as the best forex broker in the UK.

You see, if all you want to do is trade forex, then Forex.com is a great broker. Just don’t expect a massive selection of assets other than the 80+ currency pairs they offer.

You also have a selection of trading platforms to choose from, including Forex.com’s own Advanced Platform, as well as the classic MetaTrader 4.

Which is the Best Investment Platform in the UK?

This Dutch-based financial institution has managed to develop a serious stock investment broker that feels and operates like a regular online broker.

To us, it’s a perfect combination.

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✔ No demo account

✔ Rather high commission

✔ Stocks at wholesale prices

✔ One of the biggest brokers in Europe

✗ No demo account

✗ Rather high commission

Fees: Charges commission and other trading fees

Demo Account: No

Min. Deposit: N/A

Assets: Thousands

License: FCA and AFM (Netherlands)

When looking for long-term investment opportunities, most online derivatives brokers won’t cut it.

That’s why we’ve put DeGiro – a household name for UK stock investors – on this list, even though they charge a pretty high commission for their services.

DeGiro has been in business since 2008 and currently offers online access to more than 60 security exchanges from all over the world.

That means you can access securities such as stocks, options, bonds, and ETFs at wholesale price, directly from the exchange in question.

General Trading Guide

How Do I Choose a Trading Platform?

Finding the right broker is a matter of personal preference, meaning the best broker for you might not be the best broker for someone else.

The decision is mainly based on the assets you’re looking to trade and your level of experience. For example, a broker with an advanced platform is not the best option for a beginner, while stock traders need to find a broker with a good selection of stocks.

Having said that, there are also a few other characteristics that you have to consider, which we look very closely at when reviewing brokers.

The main criterion for any broker to be considered serious is that it’s fully licensed and regulated. In the UK market, that means the broker needs a license from the Financial Conduct Authority (FCA).

However, there are several other legitimate financial regulatory bodies in the world, for example:

- Cyprus Securities and Exchange Commission (CySEC) in the EU

- Australian Securities and Investment Commission (ASIC) in Australia

- Financial Sector Conduct Authority (FSCA) in South Africa

- Monetary Authority of Singapore (MAS) in Singapore

In addition, everyone should always look at a broker’s reputation among clients and competitors, the user-friendliness of the platforms, as well as the fees, to ensure that you’re not paying too much to trade.

When we review brokers, we look carefully at all these requirements and put countless hours into testing each broker and every feature they offer. Any broker that does not live up to our strict standards, will not be recommended on this site.

How Do I Start Trading in the UK?

Whether you’re looking to start trading forex, stocks, cryptocurrencies or any other security, the first step is to find a reliable broker to trade with.

That being said, all the brokers that we recommend above are suitable for beginners. So instead of just looking at the brokers that are beginner-friendly, you should find a broker that offers the assets you’re looking for and that suits your budget.

We talk more about fees and budgeting in the following section.

For example, at the beginning of this article, we recommend the best forex broker in the UK, as well as the best investment broker, etc.

In the end, it’s a personal preference and as long as the broker is licensed and regulated, and you feel comfortable with your decision, you’re good to go.

What is a Good Investment Fee?

There is no one answer to this question as it all depends on your budget and the assets you’re investing in or trading with.

Generally speaking, you want to pay as little as possible, meaning the lower the fees, the better it is.

The beauty of using online brokers is that they tend to keep fees to a bare minimum. There is usually a minimum first deposit amount of between £50 and £250 to activate your account. After that, you can usually trade without commission and only get charged the spread (the difference between the ask and bid price).

Spread is a dynamic fee that changes depending on the asset you’re trading and the type of position you’ve opened.

When long-term investing, you can expect to pay a commission on your investments. That includes DMA investments with online brokers such as IG Markets, or share dealing with a broker such as DeGiro.

In case you want to day trade for free, there is really only one good option. Just keep in mind that you can’t make real profit using this method since you’ll be trading with virtual funds.

You see, most online brokers offer a free demo account that allows you to day trade under real market conditions, but without the risk or fees. It’s a great way to practice trading and to grow your confidence before you start trading using real money.

Is Forex and Stock Trading Legal in the UK?

Yes, trading is legal and fully regulated in the UK.

The Financial Conduct Authority (FCA) is in charge of overseeing the financial sector, including all brokers, and as long as you use a regulated and approved broker, trading is completely legal.

This includes trading and investments of the exchanges, CFD trading, forex trading, spread betting, binary options, etc.

Do You Get Taxed on Forex and Stock Trading in the UK?

The answer to this depends on how and what you’re trading, but, generally speaking, you do get taxed on forex and stock trading in the UK. How much you pay in tax is calculated on your other sources of income, as well as where in the UK you live.

Now, there is one method of online trading that is actually completely tax-free and that is spread betting.

Since spread betting is legally considered betting and not trading, it’s exempt from all taxes. Several of the brokers we recommend in this article do offer spread betting if you’re interested in that.

However, besides spread betting, traders and investors are taxed on any profits they make.

Can I Start Trading with $100?

Yes. As a matter of fact, you can start trading with as little money as you like. The only limitation is that all brokers have a minimum initial deposit that you have to make in order to activate your account.

Luckily, that minimum limit is often £100, meaning you should have no problem getting started day trading with that amount.

Furthermore, we always advise beginners to start small and work themselves up. There is no need to trade for thousands of pounds when you first get started because chances are that you won’t make a profit at first.

Also, the golden rule of trading budgets is to never trade using funds you can’t afford to lose.

Didn’t find your trading platform? Check out another list of the best trading platforms in the UK

FAQ

How Do I Choose a Broker?

How Do I Start Trading for Beginners?

Where Should a Beginner Invest?

How Can I Trade Forex in the UK?

How Do I Start Forex Trading for Beginners?

Who Has the Lowest Fees for Online Trading?

What is the Cheapest Way to Invest?

Where Can I Day Trade For Free?

How Can I Invest Without Fees?

Where Can I Go to Day Trade for Free?

Which Online Broker has the Lowest Fees?

Is Trading in the UK Illegal?

Do Forex Traders Pay Tax in the UK?

How Do Beginners Invest in Stocks with Little Money?

How Much Money Do You Need to Start Day Trading in the UK?

Can You Day Trade Without 25K?

How Many ISAs Can I Have in the UK?

Can I Trade Without a Broker?

Can I Trade Forex Without a Broker?

Technically, it’s possible to trade forex without a broker but it’s not advisable. A broker provides all the tools you need to trade as efficiently as possible and forex brokers offer leverage, meaning you can invest small amounts and get greater payouts.

Trading forex without a broker requires large amounts of money.

Are Forex Brokers Honest?

Where Can I Trade Forex for Free?

Which Platform Do Professional Traders Use?

Which Broker has the Lowest Brokerage?

Can I Buy Shares Without a Broker?

Conclusion

By now, you should have a grasp of what a great trading platform is and which the top brokers in the UK are.

For more information about each broker, you can read our comprehensive broker reviews. In the reviews, we breakdown the brokers in detail to give you all the information you need in one place.

We also offer guides on other platforms, such as mobile trading, as well as recommendations for trading in different jurisdictions.

Note: No information, nor financial advice related to online trading is offered through comment.

Trading Platforms, Brokers & Apps That We Tested:

- Markets.com

- 24Option

- IQ Option

- BDSwiss

- HotForex

- Trade.com

- Libertex

- Plus500

- XTB

- InstaForex

- IG Markets

- GKFX

- LionsFX

- Valutrades

- XM

- IronFX

- Blackwellglobal

- FPMarkets

- AmanaCapital

- Admiralmarkets

- Alvexo

- Bizintra

- Pepperstone

- Windsorbrokers

- FXPro

- ForexTime

- HYCM

- FXGrow

- TeleTrade

- Trader.online

- Marketscube

- Finmaxbo

- FXCC

- Oanda

- Forex.com

- LCG

- CMC Markets

- FXCM

- iForex

- IFC Markets

- Aaatrade

Is Trading Allowed In My Country?

CFD Regulation Country by Country. The CFD trading services we are listing in this article are available in the following countries.

Europe:

- Albania

- Bosnia & Herzegovina

- Bulgaria

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kosovo

- Latvia

- Lithuania

- Macedonia

- Malta

- Moldova

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Serbia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

Excluded: Belgium

North America

- Belize

- Canada

- Costa Rica

- Cuba

- Guatemala

- Honduras

- Jamaica

- Mexico

- Nicaragua

- Panama

- Puerto Rico

- The Bahamas

Excluded: United States

South America

- Argentina

- Bolivia

- Chile

- Colombia

- Dominican Republic

- Ecuador

- Guyana

- Paraguay

- Peru

- Suriname

- Uruguay

- Venezuela

Excluded: Brazil

Africa

- Algeria

- Angola

- Benin

- Botswana

- Burkina Faso

- Burundi

- Cameroon

- Central African Republic

- Chad

- Democratic Republic of Congo

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Guinea-Bissau

- Kenya

- Lesotho

- Liberia

- Libya

- Madagascar

- Malawi

- Mali

- Mauritania

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Republic of the Congo

- Rwanda

- Sierra Leone

- Somalia

- South Africa

- South Sudan

- Sudan

- Swaziland

- Tanzania

- The Ivory Coast

- Togo

- Tunisia

- Tunisia

- Uganda

- Western Sahara

- Zambia

- Zimbabwe

Middle East

- Georgia

- Armenia

- Azerbaijan

- Iran

- Iraq

- Syria

- Lebanon

- Cyprus

- Israel

- Jordan

- Saudi Arabia

- Kuwait

- Bahrain

- Qatar

- United Arab Emirates

- Oman

- Yemen

Asia

- Afghanistan

- Bangladesh

- Cambodia

- China

- China

- India

- Indonesia

- Japan

- Kazakstan

- Kirgizistan

- Laos

- Malaysia

- Mongolia

- Myanmar

- North Korea

- Pakistan

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Thailand

- Turkmenistan

- Uzbekistan

- Vietnam

Excluded: Hong Kong

Oceania:

- Australia

- New Zealand

Read more about him by visiting his LinkedIn profile or contact us directly to learn more about the team.Our Author:

COMMENTS